makes the place I doubled my money on in 4 years seem a very good buy.

Absolutely, over the years I was often well under the water and only came out good in the end. More stress than even digital audio.😉

Someone who bought a 100k rancher in 1984, sold it for 650K in 2016. Not 2 million, 0.65 million.

The difference is in averaging in over a lot of diverse (economically) areas. I used the numbers from what a close friend did: he bought the house I described in Menlo Park in '83, then sold for slightly over $2MM a couple years ago. If you average in Vallejo (also Bay Area), then you'll pull down the appreciation rate number. But the start-ups weren't in Vallejo, they were in Palo Alto, Menlo Park, Cupertino, places like that, and house prices have gone insane, much to the delight of longer-term residents.

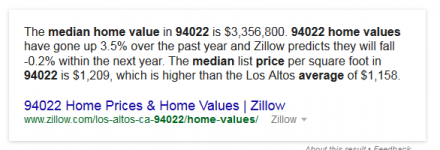

My "one piece of actual data" (CAGR = 5.28% per year for 22 years) was in zip code 94022, Los Altos, where the median home value today is $3.35 million according to Zillow. It was a desirable place to live in 1984 and 1992, and homes weren't cheap to buy even back in the day. Same for Menlo Park, Palo Alto, etc.start-ups weren't in Vallejo, they were in Palo Alto, Menlo Park, Cupertino, places like that, and house prices have gone insane, much to the delight of longer-term residents.

Attachments

Last edited:

The crazy part is the length of time it's been able to compound. The rate itself is very high, but more so that it's been, what, 35-40 years of substantial growth?

Yes, it is crazy. There are still housing bubbles in places, and stocks are overvalued as well. Some important questions are: (1) when will corrections occur, and (2) how smooth or abrupt will the corrections be?

When I had a bad moment and thought of selling..... yes, I could make a profit... but if I intended to buy another house and not move into a rental at a trailer park, I would have to spend it All on the next place. No point in that. And, no point in a big salary area if the bank and real estate people get most of it. So, paying off a place you like is what is necessary or one can never retire if you have mortgage payments. Then, I bought where it was cheap--- Asia... (almost) free and great medical care and no property taxes and cheap and healthy food etc. Oh and banks actaully pay a decent interest rate.

Worked for me. Soon summer will be over and the rain/snow/cold time is coming.... going to my condo in Asia for the duration where it is warm... gone in October.

-Richard

Worked for me. Soon summer will be over and the rain/snow/cold time is coming.... going to my condo in Asia for the duration where it is warm... gone in October.

-Richard

Last edited:

House? You were lucky to have a HOUSE! There were a hundred and sixty of us living in a small shoebox in the middle of the road.

House? You were lucky to have a HOUSE! There were a hundred and sixty of us living in a small shoebox in the middle of the road.

And we LIKED it!

Shoebox! You were lucky to have a shoebox. We lived in a pothole... etc. Classic stuff.

Much thanks, as always,

Chris

Much thanks, as always,

Chris

One of my favorite routines, along with the Live at the Hollywood Bowl sketch on the history of the jape.

The compound annual growth rate of SF Bay Area real estate has been 6.02 percent per year

When I had a bad moment and thought of selling..... yes, I could make a profit...

depends of course what is meant by a lot. I have a friend from uni who joined TI and clears about 4x his basic salary in options each year.

In engineering economics, investments have to be compared to know if it is a "loss" or a "profit". House's CAGR=6% means nothing without such comparison. Because in the hand of some businessmen, return on investment can be very high (unfortunately it is difficult to quantify the risk)...

Unlike stocks/options, house prices are usually increasing almost exponentially (and the risk on the investment is very low). It means, from investment perspective, when we sell a house it is usually a "loss", unless may be we have a better investment option for the money...

Investment in property seems to be a very profitable option in many countries. Most profitable it seems, if the property itself is used to generate another income...

When I had a bad moment and thought of selling..... yes, I could make a profit... but if I intended to buy another house and not move into a rental at a trailer park, I would have to spend it All on the next place. No point in that. And, no point in a big salary area if the bank and real estate people get most of it. So, paying off a place you like is what is necessary or one can never retire if you have mortgage payments. Then, I bought where it was cheap--- Asia... (almost) free and great medical care and no property taxes and cheap and healthy food etc. Oh and banks actaully pay a decent interest rate.

Worked for me. Soon summer will be over and the rain/snow/cold time is coming.... going to my condo in Asia for the duration where it is warm... gone in October.

-Richard

🙂

(Service is Asia is also amazing)

One of my favorite routines

Even better if one has ever experienced a Dork from York.

Don't forget that you can work at several startups over a career. I myself worked at five of them, after leaving the Soulsucking DJIA Multinational Conglomerate. Three of them went public, one was acquired by a public company, and one went belly-up. So, among the people I worked directly with, approximately 80% of them (four fifths) did very well with stock options.And of course for each one that made it at a startup, how many didn't?

The often-repeated analogy is: stock options in startup companies are like lottery tickets. If you stay at your job and vest additional options at your current startup, that's buying another lottery ticket with the same number. If you move to a new job at a different startup, and vest some options there, that's buying a lottery ticket with a different number.

Don't forget that you can work at several startups over a career.

Bingo. I worked at four of them, three of which I was a founder.

Don't forget that you can work at several startups over a career. I myself worked at five of them, after leaving the Soulsucking DJIA Multinational Conglomerate. Three of them went public, one was acquired by a public company, and one went belly-up. So, among the people I worked directly with, approximately 80% of them (four fifths) did very well with stock options.

Well you aren't sitting on a yacht in the Caribbean so not sure that gives a great view on the media presentation of of silicon valley start up wealth generation vs the stress of a startup.

And yes I am jaded from a company tour of mountain view back in 2000 just before the bubble burst. Everyone seemed high on the belief they couldn't lose. IIRC all of them lost.

And I have a friend whose goal in life after uni was to join a company that would be taken over by microsoft and retire at 25. He managed that somehow!

But as ever the plural of anecdote it not data. we all have single points that hide the full horror of the bay area.

Soulsucking

I'm dying to hear what the license plate (holster) of your electric vehicle reads.

Last edited:

I don't have a license plate holder or an electric vehicle. My car is a boring 2007 model year with an internal combustion engine. I got cured of auto-lust by owning a BMW and paying for its frequent servicing & repairs. After the auto club threatened to cancel my membership because I was "abusing" my tow privileges (3 tows in a 12 month period), I sold the Bimmer and replaced it with a boring but very reliable Japanese sedan.

Well you aren't sitting on a yacht in the Caribbean.

Yes, better ask this Caribbean guy...

Attachments

- Status

- Not open for further replies.

- Home

- Member Areas

- The Lounge

- John Curl's Blowtorch preamplifier part II