I dunno. Might be easier timing to wait and short these bubbles.

Not that I am recommending anything...no...don't do it!

Not that I am recommending anything...no...don't do it!

Might be easier timing to wait and short these bubbles.

The thought has crossed my mind... but there that "Infinite Losses" scenario...

Can you image shorting Apple and going into a 10 year coma?

I sure wish I had gone long Apple in 2003 and then gone into an 18 year coma. I was hooked on day-trading at the time and got burned so much I gave up completely. The remorse I have about the huge amount of money I could be rolling in today has reconfigured my brain's pathways and am now a loyal follower of the prophet Buffet.

I don't trust the market at the moment. It's not just the crowd-funded short squeezes (which are an interesting social media phenomenon) but mostly the elevated P/Es. Some explain this by the lack of good investing alternatives, but even so. At some point the S&P500 P/E will go back to normal (typically below 20) and this will either be by earnings soaring or it will be by prices crashing. We are in a global pandemic. Place your bets.

I don't trust the market at the moment. It's not just the crowd-funded short squeezes (which are an interesting social media phenomenon) but mostly the elevated P/Es. Some explain this by the lack of good investing alternatives, but even so. At some point the S&P500 P/E will go back to normal (typically below 20) and this will either be by earnings soaring or it will be by prices crashing. We are in a global pandemic. Place your bets.

Last edited:

I'm a little (maybe a lot) more optimistic.

To me, coming out of this Pandemic is like coming out of WWII, and Spanish Flu of the 20's. With Biden in and ready to make monster infrastructure investments, the economy will pick right back up by summer and fall 2021....but must watch inflation for the first time in 20 - 30 years...

The companies that did well during Pandemic will continue doing OK moving forward, but the ones that got killed (and did not go bankrupt) will catch up... and watch the forward PEs. The TTM PE kinda skewed to the high side now with the lowered profits and/or huge losses during last 9 months - their earnings dropped far more than their price.

To me, coming out of this Pandemic is like coming out of WWII, and Spanish Flu of the 20's. With Biden in and ready to make monster infrastructure investments, the economy will pick right back up by summer and fall 2021....but must watch inflation for the first time in 20 - 30 years...

The companies that did well during Pandemic will continue doing OK moving forward, but the ones that got killed (and did not go bankrupt) will catch up... and watch the forward PEs. The TTM PE kinda skewed to the high side now with the lowered profits and/or huge losses during last 9 months - their earnings dropped far more than their price.

You may be right. 🙂 Optimism has cost me more money in the past than pessimism, so I'm skittish. Apple is one of the biggest companies on Earth; it has $2.3T market cap and a P/E of 37 and a fwd P/E of 29. Too expensive for me at the moment. Apple products, not as exciting to me as they used to be, either.

I have never been an Apple guy. I had to have an iphone for work and hated it...never own the stock unfortunately...

Wintel box and Android for me.

Wintel box and Android for me.

A friend of mine found himself with $200k in 'spare' money in the '90s.

He took a very German stance to buying shares with it: He spent half each on his two favourite companies. His BMW shares quadrupled since then ie a bit of a dud.

With the other half he bought Apple shares at around $12 each.

Currently worth $134 but also have been split 7x so each of his shares is now worth $938.

He took a very German stance to buying shares with it: He spent half each on his two favourite companies. His BMW shares quadrupled since then ie a bit of a dud.

With the other half he bought Apple shares at around $12 each.

Currently worth $134 but also have been split 7x so each of his shares is now worth $938.

Member

Joined 2009

Paid Member

I lost some money decades back (trivial to me now) and became risk adverse. It’s fun reading about the 16 year old millionaires and the guy who bought coke when it was a buck but that’s not me. It took me awhile to figure out what I was comfortable with and what balance suits me, between fear and greed. I was disappointed to realize that I am not of the personality that would give me as much wealth as your friend Charles, but so be it. At my age it is perhaps more important to avoid a large and irrecoverable loss, yet I am still learning and my opinion is avoid these short term trends unless you are young or have money enough for the gamble, or have the personality to enjoy it.

Last edited:

Best Stock advice came from my uncle -

Buy when everyone is selling and sell when everyone is buying.

Never be All In.

Keep expectations in Check.

Have an exit strategy

Diversify into many industries

Buy when everyone is selling and sell when everyone is buying.

Never be All In.

Keep expectations in Check.

Have an exit strategy

Diversify into many industries

Your Uncle knew of what he spoke. Same with the millions of other wise persons just like him.

The problem lies in sticking to those tenets. It is sad to see those who have not, reached for the stars, and paid the price.

Balance and diversity rules. I may be boring but I'm also comfortable.

Ya, I have a little play money for the penny stocks and higher risks, but I only 'take to the casino what I can donate to the cause.'

I'm not getting any younger. Time to enjoy what I earned and let the rest do what I will need.

The problem lies in sticking to those tenets. It is sad to see those who have not, reached for the stars, and paid the price.

Balance and diversity rules. I may be boring but I'm also comfortable.

Ya, I have a little play money for the penny stocks and higher risks, but I only 'take to the casino what I can donate to the cause.'

I'm not getting any younger. Time to enjoy what I earned and let the rest do what I will need.

Member

Joined 2009

Paid Member

The system is rigged a bit toward the big fund managers - their rules and regulations are not quite fair

then why do the big fund managers consistently under-perform the indices?

The stuff they gotta fix: - Gamestop was 140% shorted - ie - the shorted shares able to be re-shorted, thus able to send a company stock to ZERO - something really wrong here. I am surprised Gamestop had a stock price at all... did we not learn this lesson during the Housing debacle?

140% of "the float" was short, not 140% of the shares which could be borrowed for short sales.

The beauty in all this is a small group of Joe Blow investors decide to stick it to these fund managers by convincing a few other Joe Blow investors to buy the stock (because it was so heavily shorted) causing all the managers to cover their 140% shorted positions, and covering the short positions at a extremely elevated price making for HUGE losses for them. Ha ha ha I say!!

Robinhood Financial's balance sheet was balooning, the NYSE didn't like it, the NASD didn't like it, and the Depository Trust didn't like it so they had to get a now, $3.5bn capital infusion. The probability of a delivery failure could have cascaded onto many innocent bystanders.

The first brokerage firm I saw fail was DuPont Glore Forgan in 1971 at a summer job. I've been doin' this a very long time.

Most Robinhood Financial clients probably never read their Customer Agreement. If they were better informed, they would know better that a Firm can sell you out without regard to tax consequences, can restrict your trading in any and all securities etc., etc.

The problem lies in sticking to those tenets.

Guilty as charged.

I now "collar" the stocks - move my exit strategy up as stock moves up - which kinda helps.

It is sad to see those who have not, reached for the stars, and paid the price.

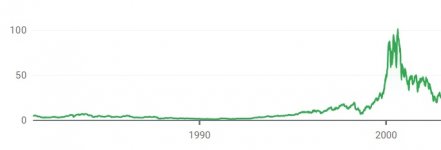

I paid the price in 2000 when the Dot Com market collapsed. Imagine leaving on your 1 month Honeymoon to Europe and coming back with your entire six figure trading account down 75%. I tried ducking into a few Internet Cafes in Rome and Paris (remember those?) to see what was going on without letting the wife know. It was painful. BUT I learned a few very valuable lessons (margin, denial, etc). I quickly learned the difference between Investing and Gambling. It took me until 2009 to use up all those Capital Loss Carryovers (and don't get me started on the current $3000/year offset to ordinary income)...

140% of "the float" was short, not 140% of the shares which could be borrowed for short sales.

The "Float" is the shares outstanding available to trade, The shares that are not in "Float" are shares held by principles in the company or financial institutions that are not able to be traded, as they require formal SEC notice, and lots of lots of paperwork.

Even at 140% of the float, it is still quite impactive!!

I paid the price in 2000 when the Dot Com market collapsed. Imagine leaving on your 1 month Honeymoon to Europe and coming back with your entire six figure trading account down 75%. I tried ducking into a few Internet Cafes in Rome and Paris (remember those?) to see what was going on without letting the wife know.

You means this? I remembered the the "Three on a Match" story and sold everything into cash a few days after the third peak, my broker thought I was nuts but I refused to reinvest any of the money for a long time.

Attachments

Yup. Makes me squirm to look at it.

I can see how some saw the third pop after the double top and stayed in...

I can see how some saw the third pop after the double top and stayed in...

In 2000, I was expecting a 20% to 30% “correction”, but I had no clue that prices could drop as much as they did. It was unbelievable to me. Back then I thought I was King Midas and nothing could go that wrong. That was my first, non-fatal blow. The second blow was my attempt to recover my losses quickly by short-term trading; sometimes worked, sometimes didn’t, but over several years it was a lot of cuts and blood loss. Still breathing, tho.

A long period of abstinence has fixed me and I’m making money again by long term investment. But I constantly have to check myself and think long term and avoid getting led into temptation by the media.

A long period of abstinence has fixed me and I’m making money again by long term investment. But I constantly have to check myself and think long term and avoid getting led into temptation by the media.

Last edited:

I spent a while back in the 90s writing code for trading systems. Some of those guys were crazy - determined to find patterns that don't exist. A lot of them used things like astrologers...

The problem with the whole stock market is that it is now a highly sophisticated (from a tech standpoint) gambling den. The original concept - allowing companies to raise money to grow, futures markets to assist agriculture, etc - is lost in a mire of gambling.

Now you have code running most of the transactions at ridiculous speeds.

It's like a feedback system with a total loss of control over loop stability.

I suspect the only way to fix this is to go back to a minimum share ownership time - even a day would be good.

Most trading never involves actual share ownership - it's just virtual.

That would lower the loop bandwidth a lot....

And we should remove all the complex derivatives - like the bundled debt devices used to hide underlying causes etc.

The problem with the whole stock market is that it is now a highly sophisticated (from a tech standpoint) gambling den. The original concept - allowing companies to raise money to grow, futures markets to assist agriculture, etc - is lost in a mire of gambling.

Now you have code running most of the transactions at ridiculous speeds.

It's like a feedback system with a total loss of control over loop stability.

I suspect the only way to fix this is to go back to a minimum share ownership time - even a day would be good.

Most trading never involves actual share ownership - it's just virtual.

That would lower the loop bandwidth a lot....

And we should remove all the complex derivatives - like the bundled debt devices used to hide underlying causes etc.

Last edited:

- Home

- Member Areas

- The Lounge

- What's your opinion on the stock exchange trends?