I think this mentality is a bit, well, martyr-istic...

You should explain to your friend any Hedge fund Manager worth his weight in salt got out of their short position already, and has now started a new short position, as the actual stock value really "worth" 1/10 of current trading price.

In the end, your friend will lose all their investment, and the Hedge Fund Manager will laugh all the way to the bank.

If your friend really wants to stick it to these managers, GETTING OUT NOW would be the best thing!

I have no skin in this game, but have been following the story for a bit now. A few things should be noted. The Reddit crowd jumped onto GME not just because they are gamers, but because right or wrong they had belief in the ability of a new executive with a proven track record to rebuild the company into profitability. Because the internet allows a degree of transparency that was not available to past generations they could see that the hedge funders had shorted 140% of the stock (a 'naked short' which is supposed to be illegal) and were basically trying to profit by driving the company into bankruptcy. GME has something like 50,000 employees that would be put out of work if it went under, and we can presume that the employee demographic overlaps that of Redditors in general (i.e. young). This read like a direct Wall Street attack on a generation, and they had the means to fight back.

As I'm writing this (8 AM PST, 1/29 - things are changing fast!), GME is back up $137 this morning, the day after Robinhood et al shut down retail buyer's ability to buy or option shares. As of last night GME shares were still shorted 120%. Some shorts were unwound, but there are not enough shares in existence to have unwound all of them. There is still some room for a squeeze. Some buyers will get out at a profit, some will get left holding the bag, but the hedge fund (Melvin) still stands to take a huge loss. Enough to make the prospect of class-action lawsuits look like the lesser evil.

Pass the popcorn, this isn't over yet.

The exposing of how manipulated the market is and who gets to “play” is the real story.

Yeah, that's what I was alluding to, the big deal here is bringing this kind of crap more into the public eye.

I think this mentality is a bit, well, martyr-istic...

You should explain to your friend any Hedge fund Manager worth his weight in salt got out of their short position already, and has now started a new short position, as the actual stock value really "worth" 1/10 of current trading price.

In the end, your friend will lose all their investment, and the Hedge Fund Manager will laugh all the way to the bank.

If your friend really wants to stick it to these managers, GETTING OUT NOW would be the best thing!

It's his money and he has equated it to going to the casino, less martyr and more "play money, lets see where this goes." I tried suggesting getting out his basis and a little to cover the short term capital gains on his fun little excursion, but he's riding it out. Others have made similar suggestions in terms of staging his exit strategy.

+10. Tax the <beep>ers.

I will be diplomatic enough to say that economic trends in the market here in the US point towards an accelerated centralization (oligarchy?) of wealth. Also the greater and greater abstraction of the stock market to a good/service with these byzantine "financial instruments." What levers/solutions we have to begin breaking this vicious cycle I don't want to speculate on, and I'm already dangerously close to being too political.

Pass the popcorn, this isn't over yet.

Yes, but understand Melvin has a massive amount of capital, and if anyone thinks this Gamestop Short Squeeze will drive them out of business, well, that dream will simply not come true.

Sadly, there is a HUGE future windfall that is going to happen when this crashes (and it will), and Melvin will be on the winning end of all those short trades, and make even more than their losses, all in a matter of days. Why would these "Crusaders" wait until they try drive it to $1000? They will run out of capital and convert additional "Crusaders" to continue buying before they get near $1000.

Hate to say it, these guys are smart and play by different rules than us Joe Blow investors. They have also managed thru Short Squeezes before, and know how to manipulate losses from clients to stay in business.

Like I said, best the "Crusaders" can do now it get out with some gains. They have effectively kick these guys in the nuts, but they now stand to get it all back and even make more money.

I just hate to see that all this good work going to waste...

when I started saving for retirement in the 70's all I bought every year was a 5 year GIC (Guaranteed Investment Certificate) funds are guaranteed up to a certain limit. They paid depending on interest rates at the time between 10% and 18% compounded every year. Try to get that now. Over the years interest rates declined and declined and the GICs were not attractive any more. After reading and reading and reading I put everything I had into the stock market. I only bought companies that paid dividends and increased their dividends every year. I have survived 3 financial downturns. Some of the companies suspended dividend increases during the pandemic and others cut their dividends. I am still earning about $27,000 a year from dividends on about $440,000 in stocks. Yes my portfolio is down a lot from 12 months ago. I didnt sell anything, I bought more when prices dipped.

if you are Canadian look up Canadian dividend all star list. That list will change a lot this year. Perhaps there is a similar list in your country.

I am not rich by any definition. I started saving when I was earning $7,500 a year. I am now earning more every year than what my salary was when I retired 20 years ago. A couple of guys I worked with for 30 years didnt save a penny and now spend more than they earn. They are in trouble financially. You can only downsize so many times.

if you are Canadian look up Canadian dividend all star list. That list will change a lot this year. Perhaps there is a similar list in your country.

I am not rich by any definition. I started saving when I was earning $7,500 a year. I am now earning more every year than what my salary was when I retired 20 years ago. A couple of guys I worked with for 30 years didnt save a penny and now spend more than they earn. They are in trouble financially. You can only downsize so many times.

Dealing in Futures was illegal in Germany from 1929 until 2006.

It is still loathed by many, not least the Porsche/Piëch family.

Their takeover of Volkswagen AG was carefully designed to bankrupt as many hedge funds as possible as an added bonus. Eventually hedge funds lost $30 billion and many went bust.

Here is what a UK DJ/Producer thinks of it. I do not know where the talking sample comes from but would like to:

Gary Clail backed by Dub Syndicate - Two Thieves And A Liar (extended version) - YouTube

It is still loathed by many, not least the Porsche/Piëch family.

Their takeover of Volkswagen AG was carefully designed to bankrupt as many hedge funds as possible as an added bonus. Eventually hedge funds lost $30 billion and many went bust.

Here is what a UK DJ/Producer thinks of it. I do not know where the talking sample comes from but would like to:

Gary Clail backed by Dub Syndicate - Two Thieves And A Liar (extended version) - YouTube

Last edited:

The Futures Market has a purpose.

Originally, the Futures Market was devised for farmers to get an idea what the next harvest of crops were relatively valued at before they even planted the seeds.

Before the Futures Market, it was a mere guess, and most guessed wrong...

Originally, the Futures Market was devised for farmers to get an idea what the next harvest of crops were relatively valued at before they even planted the seeds.

Before the Futures Market, it was a mere guess, and most guessed wrong...

I know this is not the forum for this but I really don't understand how private equity behaviour can be legal. Certainly immoral. It seems that a significant chunk of the bricks and mortar retail problems were caused by debt loading.

I'd love to be able to pull a PE move on my neighbours. Imagine the scene if you would. I walk into the best looking 10 bedroom house on the street - with the full support of my bank (I shared my 'investment thesis' with them at a private meeting) - and tell the homeowners I'm buying their home and everything in it - furniture, car, the lot. Their bank (the equivalent of the stock holders in the target) agree. I tell the homeowners that THEY will take out a loan on their property and pay it off in my name. And while I'm at it I'll charge something like 2% per month on the value of their property as a management fee.

As soon as I take over, I flog bits of the garden off, the rooms get sold to other neighbours and I boot 2 of the 5 family members into the street to cut running costs. If the homeowner had any patents, I'll flog those off since a good portfolio in a big old tech company id worth billions.

Once I'm finished, I have 3 rooms left out of a 10 bedroom house but because I've rescheduled the debt, those three rooms are worth more than the original house. I flog those off to the highest bidder and walk away leaving a total shambles for someone else to deal with.

I've been through this. It stinks and in my book its not ethical.

It is still loathed by many, not least the Porsche/Piëch family.

Their takeover of Volkswagen AG was carefully designed to bankrupt as many hedge funds as possible as an added bonus. Eventually hedge funds lost $30 billion and many went bust.

I did wonder at the time what the point of the whole Porsche takeover of VW was about. IIRC correctly it caused the loss of at least one of the board members (Bernd Pischetsrieder)? aside: still not sure I can pronounce Pischetsrieder properly, a bit like Eichhoernchen, the british tongue was not programmed for it.

Pee-shets-reeder.

And yes Eichhörnchen does screw with native English speakers. The problem is that there are no sounds like the 'ch' or the 'ö' in English at all.

Kärcher is another good one, the way they say it in UK ads isn't even close.

The point of the VW purchase by the Porsche/Piëch family was mostly to own VW given that Dr Porsche's grandson Ferdinand Piëch had been VW CEO for a long time by then.

Screwing over hedge funds was just a very welcome bonus when it became obvious that it would be exceedingly easy.

Seems there is a rule which requires one to announce in advance if one intends to purchase 75% of a company if asked.

So the family denied that which was true because they acquired 74.9%.

Hedge funds then traded the remaining 25% among themselves blissfully unaware that the federal state of Lower Saxony owned 20% of shares which they will never sell under any circumstances so they ended up having promised to trade 25% when only 5.1% were ever available.

Sh*t happens if you don't do your homework!

Btw insider trading was never illegal in Germany. It is not very important if trading in futures is.

And yes Eichhörnchen does screw with native English speakers. The problem is that there are no sounds like the 'ch' or the 'ö' in English at all.

Kärcher is another good one, the way they say it in UK ads isn't even close.

The point of the VW purchase by the Porsche/Piëch family was mostly to own VW given that Dr Porsche's grandson Ferdinand Piëch had been VW CEO for a long time by then.

Screwing over hedge funds was just a very welcome bonus when it became obvious that it would be exceedingly easy.

Seems there is a rule which requires one to announce in advance if one intends to purchase 75% of a company if asked.

So the family denied that which was true because they acquired 74.9%.

Hedge funds then traded the remaining 25% among themselves blissfully unaware that the federal state of Lower Saxony owned 20% of shares which they will never sell under any circumstances so they ended up having promised to trade 25% when only 5.1% were ever available.

Sh*t happens if you don't do your homework!

Btw insider trading was never illegal in Germany. It is not very important if trading in futures is.

I guess if you're going to play in this arena you should know the game rules better. I do not feel a bit sorry for the hedge fund managers. They just need to learn more before playing in this game.

Investing: Buying and holding a small set of the broadest low expense mutual funds with an appropriate asset allocation, disciplined rebalancing periodically, never all in or all out.

Gambling: Buying individual stocks, options, futures in businesses in which you have no insight, rushing into and out of large positions frequently and without understanding the actual risk or tax consequences. Letting websites goad you into "screwing the big guys on Wall Street" by bidding stocks to stratospheric prices and imagining you are winning.

I've been investing for 45 years, own zero individual company shares, options or bonds, and sleep very well at night. The "market" goes up and down month to month and year to year but over the long haul it goes up very nicely.

Gambling: Buying individual stocks, options, futures in businesses in which you have no insight, rushing into and out of large positions frequently and without understanding the actual risk or tax consequences. Letting websites goad you into "screwing the big guys on Wall Street" by bidding stocks to stratospheric prices and imagining you are winning.

I've been investing for 45 years, own zero individual company shares, options or bonds, and sleep very well at night. The "market" goes up and down month to month and year to year but over the long haul it goes up very nicely.

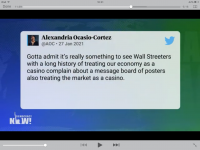

Kinda agree with this in response to the gamestop debacle:

Attachments

Last edited:

Robert Reich has said almost the same thing - it’s ok for institutional investors to game the system but not for average Joe to try it.

Owning stocks is a good investment. I think the problem is there are too many shenanigans going on that are not covered by law, or are unethical.

I read that GameStop had 50 k employees. So the hedge fund were quite happy to drive them to the wall with no concerns for the consequences. That’s the issue with Wall Street (same stuff happening this side of the pond as well so it’s not just a US issue).

I read that GameStop had 50 k employees. So the hedge fund were quite happy to drive them to the wall with no concerns for the consequences. That’s the issue with Wall Street (same stuff happening this side of the pond as well so it’s not just a US issue).

Last edited:

It would be interesting to watch a system/market where only big institutional investors are playing. Since the stock market is essentially a zero sum game, therefore there are no winners without losers, what are they going to do? Keep ripping off each other, randomly?

I would think that without a continuous feed of fresh meat of small investors (which also bulk most of the losses, with only a few winners) there would not be a stock market. after all.

I would think that without a continuous feed of fresh meat of small investors (which also bulk most of the losses, with only a few winners) there would not be a stock market. after all.

The Futures Market has a purpose...

All markets serve a purpose until someone figures out how to corrupt them.

Investing: Buying and holding a small set of the broadest low expense mutual funds with an appropriate asset allocation, disciplined rebalancing periodically, never all in or all out.

+1 this strategy worked for me across all the market instabilities since the 80's. Though when I was more able and motivated I did a good deal of real estate and managed to double my basic assets in my investment funds.

- Home

- Member Areas

- The Lounge

- What's your opinion on the stock exchange trends?