And thanks to all for bringing these boards to us users of DIY Audio. I could design and make my own board but I see little point in reinventing the wheel, so I buy boards too. Sometimes people don't get it right first time around, all good for next round!

Hi,

Something weird is going on with the store.

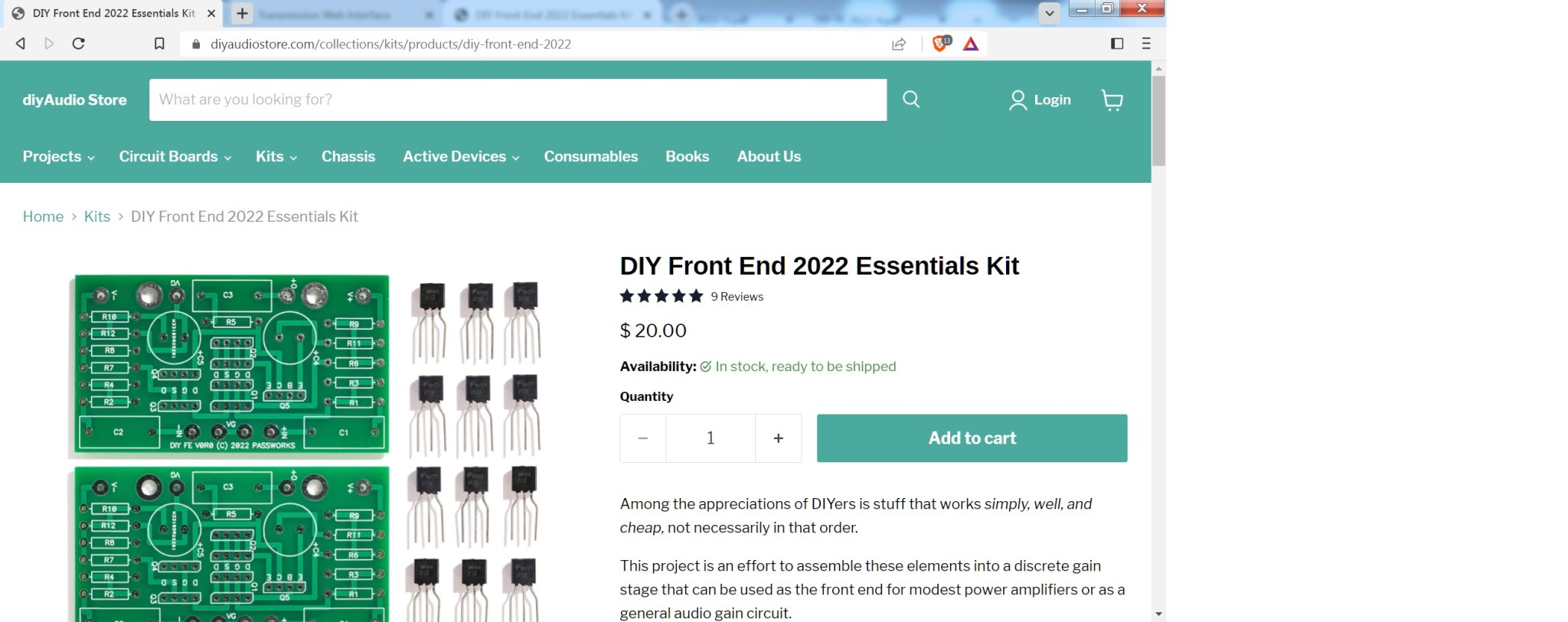

I checked the availability and price of the BA2022 essential kit and saw it was available and cost $20.

I wanted to check shipping costs (I will probably wait to order when I need a few other things) but noticed my password for the store was stored in my other browser, so changed browser and logged into the store.

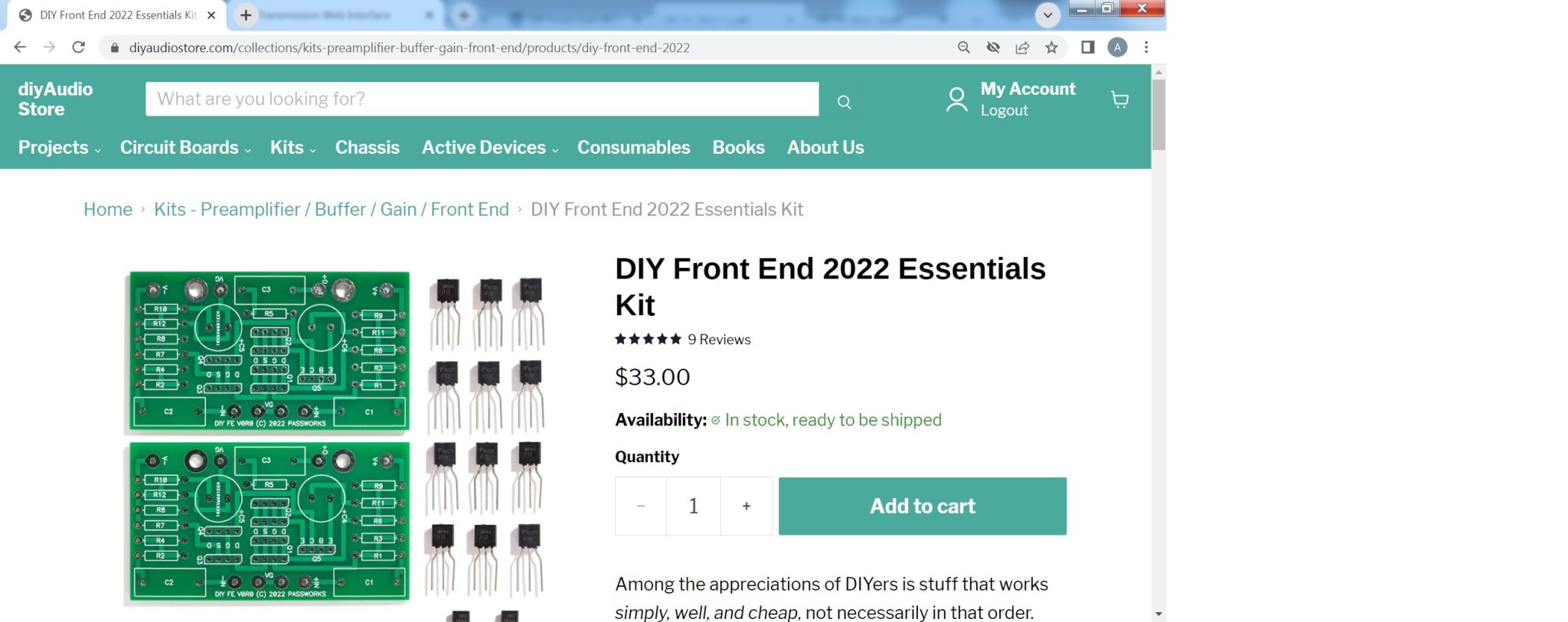

Logging in has changed the price from $20 to $33 😡

I assume this is because the store provider (shopify?) is automatically converting US$ to AU$ and charging 5% for this convenience (exchange rate is 1.575295 rather than 1.65).

I don't mind if the diyaudiostore makes a bit of extra money on foreign exchange, but don't think the store will receive the money. I think it is the shop/payment provider (shopify) who is making the extra profit for a "convenience" I cannot switch off.

Is there a way to order and pay in US$?

Something weird is going on with the store.

I checked the availability and price of the BA2022 essential kit and saw it was available and cost $20.

I wanted to check shipping costs (I will probably wait to order when I need a few other things) but noticed my password for the store was stored in my other browser, so changed browser and logged into the store.

Logging in has changed the price from $20 to $33 😡

I assume this is because the store provider (shopify?) is automatically converting US$ to AU$ and charging 5% for this convenience (exchange rate is 1.575295 rather than 1.65).

I don't mind if the diyaudiostore makes a bit of extra money on foreign exchange, but don't think the store will receive the money. I think it is the shop/payment provider (shopify) who is making the extra profit for a "convenience" I cannot switch off.

Is there a way to order and pay in US$?

I bought an ACA mini essentials kit for $25, and it turns out I have to pay $28 more in customs import fees (I'm in Europe). This never happens when I buy from Mouser, where prices and fees are totally transparent. Of course, this makes future buying from your shop impractical due to the hidden costs.

I've been a DK and Mouser customer for years. As I live in Canada, Mouser's prices have included "Incoterms", that is they include your country's state and/or local and import taxes. That's why they don't show them, so you don't see any of those import fees. I also do not get charged any extra by the courier.

In the case of DIYA store, when I purchased recently I paid the same taxes and fees of the courier that you do (except for those country differences) Once the folks at the store ship it out, it's really out of their hands! In every sense! 😉

In the case of DIYA store, when I purchased recently I paid the same taxes and fees of the courier that you do (except for those country differences) Once the folks at the store ship it out, it's really out of their hands! In every sense! 😉

We invested a lot of time and money into offering DDP (delivered duties paid) services over the last few years, and stopped offering DDP about 6 months ago as the reality for a micro-business like ours is that the costs of managing DDP were untenably high, which would have flowed into the prices of the products in the store. Very large companies have teams of boffins working on solving this problem for you, which we don't have. And even companies like Zonos who could have provided us a 3rd party solution to handling DDP have to pad their margins heavily - the end result is you would have paid more. If a company does offer you DDP services then you are paying more than if they did not.

We've undertaken a number of business simplifications over the last 2 years, including stopping with dropshipping, in order to remove operations frictions. You will start to see the benefits of those changes soon in the form of more, and more frequent product offerings.

Trying to crack the DDP nut again is still on the cards, but not for a few years and only when the store has grown substantially.

Vincent - you might like to try arrange with other DIYers to order a bunch into your country or the EU and then distribute from within the EU. The bulk of the $28 you describe was almost certainly a "per shipment" customs fee you were charged, not a "per item" fee. The best way to reduce that fee in the future is with your vote in the next election, but I don't see the EU removing their customs fees or VAT.

We've undertaken a number of business simplifications over the last 2 years, including stopping with dropshipping, in order to remove operations frictions. You will start to see the benefits of those changes soon in the form of more, and more frequent product offerings.

Trying to crack the DDP nut again is still on the cards, but not for a few years and only when the store has grown substantially.

Vincent - you might like to try arrange with other DIYers to order a bunch into your country or the EU and then distribute from within the EU. The bulk of the $28 you describe was almost certainly a "per shipment" customs fee you were charged, not a "per item" fee. The best way to reduce that fee in the future is with your vote in the next election, but I don't see the EU removing their customs fees or VAT.

That's something you can take up with your government. I'm pretty sure DIYaudio Store has no influence on your import tax rates. 😉I bought an ACA mini essentials kit for $25, and it turns out I have to pay $28 more in customs import fees (I'm in Europe).

They're actually not "totally transparent". You're right that the final price that you see on Mouser is what you end up paying in the end, including import fees, taxes, whatnot. What they are not transparent about is that they add 10-15% to their prices when you use the DDP (delivery duties paid) option. You can test this pretty easily by looking up a product on Mouser with your local currency and DDP selected. Then convert the cost to USD and change Mouser's settings to USD with incoterms: FCA. Do the math.This never happens when I buy from Mouser, where prices and fees are totally transparent.

I just ordered about $2k worth of components for my next board build. I saved about $200-300 by selecting USD, incoterms FCA rather than my country default of CAD, DDP.

Yeah. It's a non-starter for a small business.We invested a lot of time and money into offering DDP (delivered duties paid) services over the last few years, and stopped offering DDP about 6 months ago as the reality for a micro-business like ours is that the costs of managing DDP were untenably high

Tom

Actually, of the $28, $8 are the taxes (normal and expected), and $20 are "processing fees" that the private transport company is extorting.The bulk of the $28 you describe was almost certainly a "per shipment" customs fee you were charged, not a "per item" fee. The best way to reduce that fee in the future is with your vote in the next election, but I don't see the EU removing their customs fees or VAT.

The next elections won't change anything. Although the US is EU's largest trading partner, there are no plans for a free trade agreement, the negotiations were formally closed in 2019.

It's normal to pay import taxes and VAT, but, without DDP services, the fees demanded by the transporter are excessive, as detailed above. It makes such imports unviable.That's something you can take up with your government. I'm pretty sure DIYaudio Store has no influence on your import tax rates. 😉

They're actually not "totally transparent". You're right that the final price that you see on Mouser is what you end up paying in the end, including import fees, taxes, whatnot. What they are not transparent about is that they add 10-15% to their prices when you use the DDP (delivery duties paid) option. You can test this pretty easily by looking up a product on Mouser with your local currency and DDP selected. Then convert the cost to USD and change Mouser's settings to USD with incoterms: FCA. Do the math.

I'm happy with how Mouser works: on checkout, they add 21% tax, and shipping is included. When I click the "Buy" button, I know exactly how much it's going to cost. No unpleasant surprises here.

I have noticed that the processing/brokerage fees imposed in the EU can be pretty punitive. Is there a way around that that doesn't involve DDP?It's normal to pay import taxes and VAT, but, without DDP services, the fees demanded by the transporter are excessive

For example, if I receive a package by "orange" FedEx (so their 'air' services - not FedEx Ground) they normally charge a $10 brokerage fee to take the package across the border. But they'll do it for free for anyone with a FedEx account, which is free and easy to set up. So basically I get free brokerage with FedEx and use them a lot for that reason. Then I only pay the sales tax on import.

Is there something similar with FedEx or UPS in the EU?

I'm asking because this is an obvious sticking point for many of my customers in the EU and I would like to provide better service. If that means nudging the customers towards a particular shipping service that'd be good knowledge to have. I'm sure Jason would be interested as well.

Tom

There's a trade agreement between Canada and the EU. That doesn't change the brokerage fees. Basically the import fees break down like this:Although the US is EU's largest trading partner, there are no plans for a free trade agreement, the negotiations were formally closed in 2019.

- Brokerage: What the courier charges to process the customs paperwork

- Fees: Some couriers charge a separate billing fee

- Duties: Import taxes that are negotiated in trade agreements and higher if there is no trade agreement

- Tax: Typically sales tax or VAT that's the same as when you buy the product locally

There's another little detail to keep in mind: So I mentioned the free brokerage with FedEx. Yeah... About that... It's only free for the first five items on the invoice. After that they charge a per-line fee of a few dollars. So I make sure that all my FedEx shipments that go by FCA incoterms have no more than five unique items in them. It's more of a hassle. In that $2k order I mentioned, I had to break the order up into two to stay below the five-line limit. I also ordered from Digikey but that had more to do with parts availability.

Tom

Not sure if this is the right place, but the link to the Pass diy 6-24 crossover article is broken on page: https://diyaudiostore.com/collections/crossovers/products/diy-biamp-6-24-crossover

I think it should point to https://www.firstwatt.com/wp-content/uploads/2023/12/art_diy-biamp_6-24_-crossover.pdf

I think it should point to https://www.firstwatt.com/wp-content/uploads/2023/12/art_diy-biamp_6-24_-crossover.pdf

Jason, I just found out the bergquist pads supplied with the F5M kit are non insulating.https://mm.digikey.com/Volume0/opasdata/d220001/medias/docus/5783/19-Q3-0.005-00-11.pdf There is basically no dc voltage across the pads due to the drain of the mosfets connected to the mosfets metal parts. However there will be ac voltage present, the value of such depending on how much output voltage the amp is putting out.Measuring the pad using a dmm and just the regular probes i get about 90 ohms. Not sure what that value would be when the larger metal surface of the mosfet is clamped down on it with pounds of pressure.You may want to run this by Nelson.

It's always something...

Thank you for this correct information.

Looking at the BOM I see Digikey part BER1340, and I don't see it when I go to Digikey, but I trust that this is the case.

Fortunately it's not an issue with the anodized sinks from the store, which insulate into the megohms, but it would be

a problem with bare metal.

Also fortunately we have not yet shipped the second batch of these kits.

Of the 100 kits that have shipped, I am happy to mail different insulators to send to anyone with bare metal sinks.

You can send your address to nelson@passlabs.com

Thank you for this correct information.

Looking at the BOM I see Digikey part BER1340, and I don't see it when I go to Digikey, but I trust that this is the case.

Fortunately it's not an issue with the anodized sinks from the store, which insulate into the megohms, but it would be

a problem with bare metal.

Also fortunately we have not yet shipped the second batch of these kits.

Of the 100 kits that have shipped, I am happy to mail different insulators to send to anyone with bare metal sinks.

You can send your address to nelson@passlabs.com

I really like the quality of the stores "blue" circuit boards, eg. The Universal Power Supply board. Can someone tell me who the manufacturer is and what thickness the copper is? Those boards withstand repeated soldering/desoldering really well. Thanks in advance.

Hi Jason and all helpfull store helpers

First of all many thanks for all your kind efforts and first grade service!

The following is just a short feedback on a topic you already know, but it might give precise figures to illustrate the importance of you finding again non expensive solutions to ship the goods to Europe.

I ordered a week ago my third essential Mini kit, that is a couple of months after the first one I ordered. Since your kind mail warning us that non expensive delivery options (DHL e-commerce...) would sadly be temporarly dropped I was wondering how costs would turn out this time. Ordering exactly the same goods at the store's same price with just shipping fees being different enabled a direct comparison of end costs.

It turns out it is far more expensensive. The problem isn't just the more expensive shipping costs to France (where I am based), which we do pay anyway to the store when ordering, but the way the total extra costs are calculated... I mean taxes by that.

It is key down here to keep an order below 150E to ensure a smooth and fast process for imports. However, by "order" the tax people understand not only the item costs, but the total of "item + shipping + handling costs". Based on this total cost they apply the 20%VAT plus roughly a total of 10% import taxes for non EU (or extra 8E minimum fee, be it handling or else all included). So the total of roughly 30% taxes is calculated on the total of "item cost + shipping cost" appearing on the invoice and not just "parts / good" cost.

In my case, whereas the shipping costs were in the past nearly non existant (6E...), the shipping costs are now nearly equal to the good cost I purchased, hence doubling the figure taken into account by the taxmen for their calculation. That is they apply roughly the same 30%, but on an amount that is now far more expensive... so the entire 30% taxes amount now is nearly double the figures it used to be.

In short: now, on top of much more expensive shipping costs due to the non expensive shipping options being delated, I did pay (nearly) twice as much extra taxes.

It is a pity as we are talking about a 24E order- small items (board + 8 small transistors) all fitting in a small padded enveloppe - that ends up costing now 61E once delivered. In the past, I got away with an end cost of 39E - when they probably didn't bother applying all taxes plus I paid online which saved a few quids - or, more reasonably and representative probably, 47E when they did apply all the taxes and I had to pay on delivery when they knocked on my door, so full costs everywhere but rather the normal and legal situation...

This post is of course not about the extra 10E or 20E I paid (would I keep ordering otherwise, or even be in that hobby LOL?), but more about the principle and understanding all this is proportional of course (remember, initial good was less than 24E).

I really hope you can find a similar solution to DHL e-commerce to avoid silly extra costs on small kits, as small 'essential kits' are sadly often far more convenient and less expensive at the end for us EU residents. It turns out then the orders can be shipped in a very simple padded enveloppe, not dissimilar to letters or documents I do receive from oversea... can't be that expensive. Of course things have to remain legal and be ran with smooth and hassle-free processes on your side, but the important bit here are not just the shipping costs, but understanding ALL THE costs appearing on the invoice joined to the goods are taken into accounts by taxmen and hence see roughly 30% taxes applied to all of them...

I hope this helps finding shipping solutions in the future for EU, whatever they may be, which was the sole purpose of this mail (it is not a complain and I do understand EU customers are probably not that numerous)

Again MANY thanks for all your efforts running a fabulous shop

Claude

First of all many thanks for all your kind efforts and first grade service!

The following is just a short feedback on a topic you already know, but it might give precise figures to illustrate the importance of you finding again non expensive solutions to ship the goods to Europe.

I ordered a week ago my third essential Mini kit, that is a couple of months after the first one I ordered. Since your kind mail warning us that non expensive delivery options (DHL e-commerce...) would sadly be temporarly dropped I was wondering how costs would turn out this time. Ordering exactly the same goods at the store's same price with just shipping fees being different enabled a direct comparison of end costs.

It turns out it is far more expensensive. The problem isn't just the more expensive shipping costs to France (where I am based), which we do pay anyway to the store when ordering, but the way the total extra costs are calculated... I mean taxes by that.

It is key down here to keep an order below 150E to ensure a smooth and fast process for imports. However, by "order" the tax people understand not only the item costs, but the total of "item + shipping + handling costs". Based on this total cost they apply the 20%VAT plus roughly a total of 10% import taxes for non EU (or extra 8E minimum fee, be it handling or else all included). So the total of roughly 30% taxes is calculated on the total of "item cost + shipping cost" appearing on the invoice and not just "parts / good" cost.

In my case, whereas the shipping costs were in the past nearly non existant (6E...), the shipping costs are now nearly equal to the good cost I purchased, hence doubling the figure taken into account by the taxmen for their calculation. That is they apply roughly the same 30%, but on an amount that is now far more expensive... so the entire 30% taxes amount now is nearly double the figures it used to be.

In short: now, on top of much more expensive shipping costs due to the non expensive shipping options being delated, I did pay (nearly) twice as much extra taxes.

It is a pity as we are talking about a 24E order- small items (board + 8 small transistors) all fitting in a small padded enveloppe - that ends up costing now 61E once delivered. In the past, I got away with an end cost of 39E - when they probably didn't bother applying all taxes plus I paid online which saved a few quids - or, more reasonably and representative probably, 47E when they did apply all the taxes and I had to pay on delivery when they knocked on my door, so full costs everywhere but rather the normal and legal situation...

This post is of course not about the extra 10E or 20E I paid (would I keep ordering otherwise, or even be in that hobby LOL?), but more about the principle and understanding all this is proportional of course (remember, initial good was less than 24E).

I really hope you can find a similar solution to DHL e-commerce to avoid silly extra costs on small kits, as small 'essential kits' are sadly often far more convenient and less expensive at the end for us EU residents. It turns out then the orders can be shipped in a very simple padded enveloppe, not dissimilar to letters or documents I do receive from oversea... can't be that expensive. Of course things have to remain legal and be ran with smooth and hassle-free processes on your side, but the important bit here are not just the shipping costs, but understanding ALL THE costs appearing on the invoice joined to the goods are taken into accounts by taxmen and hence see roughly 30% taxes applied to all of them...

I hope this helps finding shipping solutions in the future for EU, whatever they may be, which was the sole purpose of this mail (it is not a complain and I do understand EU customers are probably not that numerous)

Again MANY thanks for all your efforts running a fabulous shop

Claude

Thanks for the feedback. Apologies for the increased shipping prices to the EU, in particular in relation to the issue you raise being shipping greater than goods value for cheaper items.

We are at the mercy of the services offered by our warehouse partner, and resuming DHL eCommerce within the next 12-24 months is unlikely, possibly requiring a move to a different partner. Our focus over the next 6-12 months will be on improving our product range, making a warehouse move impractical due to the difficulty, disruption and costs involved. The irony here is that we moved to this partner specifically so we could offer inexpensive international shipping to the global international diyAudio community we care deeply for.

However, we've since negotiated significant discounts for DHL Express and now offer USPS First Class International Parcel, which can be even cheaper. For now, there is no competitor to DeC’s bulk consolidation prices, so probably the best advice I can give is order more stuff, less often, and combine your shipments into one larger shipment.

Regards VAT (as I understand it) since July 1st 2021 is no "de minimum" in the EU. Whereas before July 1st 2021 it was EUR22, now all shipments regardless of value attract VAT. Duty, which should typically be relatively small, is charged on values > 150 EUR.

Once the dust settles on our current product initiatives, another warehouse move might be on the cards. In the meantime, we'll be hoping our current partner resumes shipping with DeC. I don't think it will happen within the next 12 months.

Lastly, thank you very much for your positive energy and well wishes for the store. We try. 🙂

We are at the mercy of the services offered by our warehouse partner, and resuming DHL eCommerce within the next 12-24 months is unlikely, possibly requiring a move to a different partner. Our focus over the next 6-12 months will be on improving our product range, making a warehouse move impractical due to the difficulty, disruption and costs involved. The irony here is that we moved to this partner specifically so we could offer inexpensive international shipping to the global international diyAudio community we care deeply for.

However, we've since negotiated significant discounts for DHL Express and now offer USPS First Class International Parcel, which can be even cheaper. For now, there is no competitor to DeC’s bulk consolidation prices, so probably the best advice I can give is order more stuff, less often, and combine your shipments into one larger shipment.

Regards VAT (as I understand it) since July 1st 2021 is no "de minimum" in the EU. Whereas before July 1st 2021 it was EUR22, now all shipments regardless of value attract VAT. Duty, which should typically be relatively small, is charged on values > 150 EUR.

Once the dust settles on our current product initiatives, another warehouse move might be on the cards. In the meantime, we'll be hoping our current partner resumes shipping with DeC. I don't think it will happen within the next 12 months.

Lastly, thank you very much for your positive energy and well wishes for the store. We try. 🙂

Last edited:

Thanks a lot to you Jason.

Of course I will keep ordering whatever 🙂

Yes, your understanding is correct, VAT applies since the first penny. Duty is indeed supposed to be charged only if over 150E (good + shipping)... and is so by the Gov' indeed, but all transporters claim an "import tax", which is mainly a handling fee... to supposedly fill custom papers for non EU goods and that is at least additional 8E regardless the value. Of course this is just a way for companies (Post...) to get extra money, playing confusion with what are real duty which goes to the tax office...

At then end, if we order from you for amounts under 150E, we should get charged 20% VAT based on the Total bill, plus at least 8E. Yes, ordering more goods, for up up to 150E, makes indeed sense from a fiancial POV (shipping cost and the extra costs charged for the paper work aren't compressible). What is not so good though is that the 150E include the shipping costs and that the 20% VAT is also applied to the shipping cost. So at the end, whenever / time permitting, it would make still sense of course to reduce the shipping costs as much as possible.

Having said that, I understand it is easier said then done!

All the best for the future and thanks again for... everything

Claude

Of course I will keep ordering whatever 🙂

Yes, your understanding is correct, VAT applies since the first penny. Duty is indeed supposed to be charged only if over 150E (good + shipping)... and is so by the Gov' indeed, but all transporters claim an "import tax", which is mainly a handling fee... to supposedly fill custom papers for non EU goods and that is at least additional 8E regardless the value. Of course this is just a way for companies (Post...) to get extra money, playing confusion with what are real duty which goes to the tax office...

At then end, if we order from you for amounts under 150E, we should get charged 20% VAT based on the Total bill, plus at least 8E. Yes, ordering more goods, for up up to 150E, makes indeed sense from a fiancial POV (shipping cost and the extra costs charged for the paper work aren't compressible). What is not so good though is that the 150E include the shipping costs and that the 20% VAT is also applied to the shipping cost. So at the end, whenever / time permitting, it would make still sense of course to reduce the shipping costs as much as possible.

Having said that, I understand it is easier said then done!

All the best for the future and thanks again for... everything

Claude

- Home

- The diyAudio Store

- General diyAudio store feedback thread