I've long wondered about this. Digikey adds an import tariff on many imported items, separate from the item's price. I don't see other distributirs doing it for the same items.

Anyone know what's behind this?

Are the other distribs just absorbing it?

Anyone know what's behind this?

Are the other distribs just absorbing it?

Manufacturers and sellers find any reason to increase prices: pandemy, war, blah blah blah. Allways the same.

It depends on how they are imported into your country. It's your government that sets the import tariffs, not Digikey.

Nowadays, importers often charge the import duties and transfers them to the government on your behalf.

That saves you a lot of time, it's not unusual for shipments to linger at the customs' office for several weeks.

It also saves you money because if the importation is done separately there's often an admin charge just for doing it for you.

For instance, here in Belgium the national post office charges € 15 admin fee on top of any import duties.

Where I live, Digikey and Mouser take care of all that so the surcharge on the items price is very low, a few % at most.

But many countries don't yet have the automated system* and that costs you.

Jan

* It's an interesting system. For instance, when I order PCBs from JLCPCB in China, the order and shipping value is send to the carrier (DHL).

As soon as the order is turned over to DHL, they (DHL) immediately send the customs files to the Belgium customs and pay the tariff, and the package gets to me with no hassle and no extra costs in a few days. It does make the shipping look more expensive but the import duties (22%) are included.

Nowadays, importers often charge the import duties and transfers them to the government on your behalf.

That saves you a lot of time, it's not unusual for shipments to linger at the customs' office for several weeks.

It also saves you money because if the importation is done separately there's often an admin charge just for doing it for you.

For instance, here in Belgium the national post office charges € 15 admin fee on top of any import duties.

Where I live, Digikey and Mouser take care of all that so the surcharge on the items price is very low, a few % at most.

But many countries don't yet have the automated system* and that costs you.

Jan

* It's an interesting system. For instance, when I order PCBs from JLCPCB in China, the order and shipping value is send to the carrier (DHL).

As soon as the order is turned over to DHL, they (DHL) immediately send the customs files to the Belgium customs and pay the tariff, and the package gets to me with no hassle and no extra costs in a few days. It does make the shipping look more expensive but the import duties (22%) are included.

Yeah, sometimes DPD shipping is cheaper than paying import duties yourself (and much faster, no pesky documents and waiting for reponse, also freight forwarding agent fee).

Yes, but you're describing items shipped in from another country. I'm talking about items shipped within the US from their US warehouse.

Well that means they are imported from outside the US. The final warehouse location shouldn't matter.

What did they tell you?

Surely you've heard about the tariffs your President levvied on Chinese imports and such?

Jan

What did they tell you?

Surely you've heard about the tariffs your President levvied on Chinese imports and such?

Jan

I thought Digi only charged it to US customers. I believe they ship to other countries and do not charge it. Others probably just raise the price some to cover US tariff cost.

Yes, it says "if shipped within the USA".

I just put the same 4 items in carts at DK and the Mouse. Prices for the items are identical. DK will append tariffs on all four, Mouse on none of them.

I just put the same 4 items in carts at DK and the Mouse. Prices for the items are identical. DK will append tariffs on all four, Mouse on none of them.

That's interesting. The law is the same for both, so maybe Mouser absorbs it as a competitive advantage.

Is this stuff from China? I wonder what the tariff actually is.

Here in EU it generally is around 22% on goods and shipping cost.

Jan

Is this stuff from China? I wonder what the tariff actually is.

Here in EU it generally is around 22% on goods and shipping cost.

Jan

You should worry only about the final price you pay.

One supplier could state "XYZ gizmo: 10$" , another "7$+3$ Tariff"

Same thing.

Be CERTAIN 🙁 that Tariff is always paid for, and ultimately by you. (who else?)

By the way, nobody absorbs anything unless it´s a trivial amount, Business 101

"but, in this world, nothing is certain except death and taxes, Franklin said"

Only differences you will find, is that by using own (hired-salaried) "Customs processors" (we call the Despachante de Aduana" in Argentina) they spread costs and it´s less for individual imports, while you may have to pay the full fee on your own.

Practical example here:

* IF I use any known Courier, such as FedEx, DHL or UPS, I pay a fixed minimum "floor/threshold" typically around U$45 for small items (even if I import a 10 cent resistor) BUT they do all the Customs processing, PLUS a certain Customs Tariff around 60% of the product CIF value: Cost Freight Insurance.

So in general for small orders (less that U$200) I follow that path of least resistance.

$200 in product means I end up paying some 1.6*200+45=320+45=U$365 (182% original price) and the UPS guy rings my bell 4-5 days later

Now what in US would be an "everyday order" of, say, U$25 in parts, becomes: 25*1.6+35 (Mouser "special deal)=$75 so 300% original price 🙁

As you see, small orders are to be avoided.

* IF I try to get cheap and ask for AliExpress, China Post, etc. , which are very inexpensive AND thanks to the Gods package gets through, generally because it gets lost in the middle of Imports Tsunami, fine. But it´s some kind of Russian roulette.

BUT if they catch it, they stop it, summon me to Customs House and I need to hire a "Despachante de Aduana" who asks for a minimum fee of U$400, just for himself (Registered/Licensed Professional Fee) plus any real Tariff (usually some 20%).

Then how/what do "Official Importers" do?

Simple, they hire a Despachante on a monthly salary or retainer, cost per import is peanuts.

One supplier could state "XYZ gizmo: 10$" , another "7$+3$ Tariff"

Same thing.

Be CERTAIN 🙁 that Tariff is always paid for, and ultimately by you. (who else?)

By the way, nobody absorbs anything unless it´s a trivial amount, Business 101

"but, in this world, nothing is certain except death and taxes, Franklin said"

Only differences you will find, is that by using own (hired-salaried) "Customs processors" (we call the Despachante de Aduana" in Argentina) they spread costs and it´s less for individual imports, while you may have to pay the full fee on your own.

Practical example here:

* IF I use any known Courier, such as FedEx, DHL or UPS, I pay a fixed minimum "floor/threshold" typically around U$45 for small items (even if I import a 10 cent resistor) BUT they do all the Customs processing, PLUS a certain Customs Tariff around 60% of the product CIF value: Cost Freight Insurance.

So in general for small orders (less that U$200) I follow that path of least resistance.

$200 in product means I end up paying some 1.6*200+45=320+45=U$365 (182% original price) and the UPS guy rings my bell 4-5 days later

Now what in US would be an "everyday order" of, say, U$25 in parts, becomes: 25*1.6+35 (Mouser "special deal)=$75 so 300% original price 🙁

As you see, small orders are to be avoided.

* IF I try to get cheap and ask for AliExpress, China Post, etc. , which are very inexpensive AND thanks to the Gods package gets through, generally because it gets lost in the middle of Imports Tsunami, fine. But it´s some kind of Russian roulette.

BUT if they catch it, they stop it, summon me to Customs House and I need to hire a "Despachante de Aduana" who asks for a minimum fee of U$400, just for himself (Registered/Licensed Professional Fee) plus any real Tariff (usually some 20%).

Then how/what do "Official Importers" do?

Simple, they hire a Despachante on a monthly salary or retainer, cost per import is peanuts.

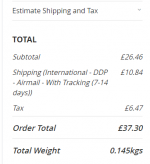

For my last order at Digikey, and that could be somewhere between 2021 and 2022, I gathered my parts for several projects so that I can benefit from free shipping. I was slapped with a surprise import fee that I never had before and which amounted to around a third of the total price of components.

I didn't see anything about that at the ordering step IIRC, and I wasn't happy about it. It might have to do with FedEx itself, but usually, the components are either from a local warehouse or else they don't add any other fee when importing from the US to Canada.

I see that Mouser has better price for the same components. I might order from them next time.

I didn't see anything about that at the ordering step IIRC, and I wasn't happy about it. It might have to do with FedEx itself, but usually, the components are either from a local warehouse or else they don't add any other fee when importing from the US to Canada.

I see that Mouser has better price for the same components. I might order from them next time.

That's interesting. The law is the same for both, so maybe Mouser absorbs it as a competitive advantage.

Is this stuff from China? I wonder what the tariff actually is.

On prior invoices it's itemized as a "Section 381 Tariff" and is 10%. It is only applied to items from China.

There something called a bonded warehouse here, items are stored without paying duty until sent.

Foreign registered ships get their items duty free in Mumbai, the ship chandlers do it all the time.

They store their items in bonded warehouses.The paper work is tedious, but duties on some items are very high, so it is an advantage.

Some items used for ships are illegal in India, so they are also stored in bonded warehouses.

And transshipment is allowed duty free, say an item bound for Nepal is unloaded at an Indian port, the importer files a bond, which is cancelled once the item reached Nepal.

Maybe these people are paying the duty once the item is sold, the actual warehouse may be in Mexico, for example.

And their competitors are paying duty, and storing it inside the USA, so their price is for duty paid items. Only thing is Canadian customers will end up paying USA duties, for example.

Foreign registered ships get their items duty free in Mumbai, the ship chandlers do it all the time.

They store their items in bonded warehouses.The paper work is tedious, but duties on some items are very high, so it is an advantage.

Some items used for ships are illegal in India, so they are also stored in bonded warehouses.

And transshipment is allowed duty free, say an item bound for Nepal is unloaded at an Indian port, the importer files a bond, which is cancelled once the item reached Nepal.

Maybe these people are paying the duty once the item is sold, the actual warehouse may be in Mexico, for example.

And their competitors are paying duty, and storing it inside the USA, so their price is for duty paid items. Only thing is Canadian customers will end up paying USA duties, for example.

Can you give me one or two part numbers? I'd be interested to see what they cost here.On prior invoices it's itemized as a "Section 381 Tariff" and is 10%. It is only applied to items from China.

I do know that Mouser ships everything to Munich in Germany and then supplies us from that warehouse. So that may be a bonded wharehouse as mentioned.

Jan

A thought: when ordering from M or DK I always select 'DDP' as incoterms.

That means that all duties and taxes are paid by the seller (and presumably included in the shipping or goods prices).

If I buy PCBs from JLCPCB I have a choice of DDP or another method, and the price differs between the two; if I select the one without the duty and taxes included, the shipping is less, but then I face the hassle and cost of doing my own importation.

It's a whole can of worms, and it pays to get up to speed with it.

Decoding the 5 Most Common Incoterms

Jan

That means that all duties and taxes are paid by the seller (and presumably included in the shipping or goods prices).

If I buy PCBs from JLCPCB I have a choice of DDP or another method, and the price differs between the two; if I select the one without the duty and taxes included, the shipping is less, but then I face the hassle and cost of doing my own importation.

It's a whole can of worms, and it pays to get up to speed with it.

Decoding the 5 Most Common Incoterms

- EXW (Ex Works) ...

- DDP (Delivered Duty Paid) ...

- FOB (Free on Board) ...

- CIF (Cost, Insurance and Freight) ...

- FAS (Free Alongside Ship)

Jan

Here in France you have to pay additional cost of custom import for Digikey but not for Mouser for items priced similarly on their catalogs.I've long wondered about this. Digikey adds an import tariff on many imported items, separate from the item's price. I don't see other distributirs doing it for the same items.

Anyone know what's behind this?

Are the other distribs just absorbing it?

The orders of both companies can be tracked as departing from the US.

Go figure 🤔 but the choice is easy.

Here in the UK we get a minimum price for most of the minimum price for international fulfilments or we end up paying for the privilege, then add shipping and VAT (sales tax). I get that with Mouser and Digikey, but Farnell is easier to get some stuff as it seems to have more within the UK for next day delivery without having the minimum price and shipping means relatively sane prices.

@jan.didden

You're right: at Mouser, DDP is selected by default hence no custom hassle.

At Digikey I'm not sure since I cancelled my account after paying an outrageous import tax 😡

You're right: at Mouser, DDP is selected by default hence no custom hassle.

At Digikey I'm not sure since I cancelled my account after paying an outrageous import tax 😡

- Home

- Design & Build

- Parts

- Digikey and import tariffs