I don't understand how you lost so much money in 2007 - you must have had it invested in products you could'nt bail out of? - never be afraid to take a profit or to take a loss. The problem is that there are so many people around who let their egos get in the way of common sense - in business ego has no value.In my case the time spent acquiring two engineering degrees paid me back by allowing me to stay in the same company and location for 41 years. I advanced up the engineering ranks to a level where I was happy, where I remained for 15 years. I enjoyed my job. I stayed in the same house for 37 years, so using any extra funds to pay down the principal on my mortgage worked for me.

You stated that you work full time and that you live in a small town. Do you currently work in an electronics related job? Will you stay in that company or physical area long term after getting a college degree? Are there other opportunities for employment in Electronics in your area? Will there be in the years to come? Will you look for employment in the electronics field if you are not working there now? Will this require a move?

I ask these questions because the answers may influence what you call investment. Anything related to the stock market caries risk. As others have stated, the risk is not always obvious, and may vary with other yet unseen forces. I took a $5000 investment to about $200K during the stock market heyday from about 2000 to the crash of 2007 when most of it vanished due to the collapse of the real estate market, which was greatly accelerated by "sub prime" loans and derivative investments. People were encouraged to take the equity out of their houses and use it to buy more property, so when the property values halved in a few months' time, a large segment of the speculative real estate holders had negative net worth, and everything crashed, taking the stock and banking markets down with it. South Florida where I lived at the time was worse case with about 1/4 of the houses in our area foreclosed and vacant. A 2006 hurricane trashed many houses making matters worse. Similar scenarios are unfolding again in several parts of the USA.

In this case paying down my mortage was a good investment. Yes, my stock market holdings went from $200K to $20K in a few months, but during the good years I had taken money from the stock market profits and completely paid off my mortgage, added a swimming pool and paid off most other debt. If you believe that you will be in the same house for several years, and property values are likely to increase long term, then use some of that monthly check to pay down the principal of your mortgage is your loan allows it. Compound interest is beneficial when you are on the receiving end but works against you when you are paying it. Make a spreadsheet for your current house loan to see how much per year goes to actually paying off the principal. In the first few years of the loan, it is very little. In my case putting money toward the loan was the right choice, but I had an 8.5% loan. Your results will be different.

The financial collapse of 2007 was the single worst event to happen since WW2. Those that managed to stay put took 3-5 years to recover. But if you needed the funds (due to job loss, health issues, margin calls, etc) and were forced to sell may have never recovered.I don't understand how you lost so much money in 2007

Selling in a panic downtrend is never good, until you absolutely have too. Egos may have a little to do with it, but sometimes its just down to not having the understanding and experience to know what to do....living thru the crash / return of the 1987 collapse helped me get thru that period...

This is the most rational post on the whole thread. I see the OP has given a thumbs up to it - keep it as a mantra and repeat every couple of days. So many of the posts are about particular countries which is completely irrelevant, especially as the OP is from Norway.To the O.P. I've made about 7% a year on the stock market. I used savings from my salary, excess to rent food transportation insurance. I dedicated about 8% a year to savings over 28 years. I never bought on margin, or dabbled in options. I drove old cars, only 2 new ones before retirement. I've owned my house since 1980 and do most of my own maintenance. It's been paid off since 1989.

Secrets to success: watch the media. Buy during panics when everybody else is selling. When everybody is bragging about their stock successes, keep your money in a checking account or cash. Sell then if you have some good profits. Indicator of state of the market, the P/E ratio. This is the invert of the interest rate. Buy at P/E ratios of roughly 10, sell at P/E ratios of 20 or above. Individual companies can have bad P/E due to bad management or startup costs. I stay away from these although I've missed the Amazons & Microsofts who won the business wars. These were balanced by a lot of startups I didn't lose money on.

Problem with mutual funds, they pile into the biggest stocks, which are on the go-go list. These are subject to huge market shifts. Everybody bails out on the same day, including your mutual fund. FANG stocks were a recent mania, punished badly by the covid crash in 2019. The tech boom of the 2000's was infamously followed by the tech bust. The mania in the seventies was conglomerates like GE & ITT. The best mutual fund I've found lately is a dividend paying stock one. Companies that increase their dividends yearly over long periods tend to do so in the future. I've done quite well on one of those. Utility stock funds are good, especially after I sold at 2% dividend rate and bought back after the prices crashed to a 3.5% dividend rate.

I've also lately (15 years) bought some individual stocks, off a brokerage recommended list mainly. Never too much in one sector. Some of the smaller stocks with decent P/E ratios got bought up by bigger companies to consolidate market share. This resulted in bidding wars with profits to me of 5:1 or better. The others fit into my 7% gain average.

I've been retired since age 58.

Everyone lost money between 2007 and 2008. Most of this was due to the real estate market collapse, especially in South Florida where speculation was rampant. I bought my "starter house" in 1978 for $37K. In 2005 similar houses were selling for over $300K. In 2008 they were selling in livable condition for $50K to $100K. Many of the unoccupied houses were trashed and unlivable. Those who had built a house of cards by taking the equity out of their primary house to buy another house to rent out and doing this multiple times were left homeless and bankrupt. I stayed in my starter house for 37 years, paid it off early and sold it when I retired and moved out of Florida. I got $215K for a small house in a crummy neighborhood half a mile from the swamp. That house has been flipped twice since I left. The last sale was for over $300K.....another collapse is inevitable.I don't understand how you lost so much money in 2007 - you must have had it invested in products you could'nt bail out of? - never be afraid to take a profit or to take a loss. The problem is that there are so many people around who let their egos get in the way of common sense - in business ego has no value.

I had invested money in stocks of the tech companies that I had worked with and known. All were cell phone related, and I had multiple friends working in each place. Nextel, a cellular carrier went from $3 per share to $40 as did Brightpoint, their distribution company. Nextel got eaten by Sprint, which got eaten by T-Mobile. At one point their stock was under $1 per share. I think that it was worth about $5 per share when it was converted to T-Mobile stock. I was out of it by then. RFMD made chips for phones, they went from $10 per share in the early 90's to $69 per share in 2000, but fell to $3 in 2008, as people weren't buying phones when they were struggling for necessities. Bellsouth was the local phone and cellular company. Their stock had a periodic swing of about $1 peak to peak on a $40 stock, and a period of about 2 days due to insider trading within their 401K accounts. We all made money day trading this one until the trading rules for 401K's changed and the stock flatlined.

Yes, my portfolio went from $200K in 2007 to $20K in 2008. I started with 5K, so I was still ahead overall, AND I had taken money out all along the way to pay off my 8.5% house mortgage and erase most other debt. The story didn't end there. While the market was down, I sold small quantities of stock at a loss to claim the loss on my taxes, worked my way out of the cellular phone stuff, but kept most of my RFMD since they also made chips for the defense industry. RFMD got swallowed up in the M/A game and is now part of Qorvo which is going for over $100 per share today. The $5K investment has paid off lots of debt, and was down to $20K in 2008, but is still worth about $50K today after taking about half of it to help built my retirement house.

And just buying shares from the big indexes instead of complicated constructions?I must respectfully say that from the tone of your comments you don't have the slightest idea what you're doing. I don't think you know what the market really is. It's not what it used to be even 15 years ago. Even with a large correction, prices are pie in the sky and don't reflect any kind of reality. Rehypothecating rehypothecated bundles of junk is what the market is today. There's many layers between the market and reality.

One of my friends made a living as a local trader on the CBOT. About 15 years ago he retired early. He said there was no money to be made for locals any more. All the money flows from one behemoth institution to another. No more middleman. He was grooming his son to take his place in the pit but that was sidelined. The party's over for the little guy.

I worked at the CBOT and CME for 25 years. I had big clients and little clients. I was barred from trading because I saw the orders before they hit the market; if I traded it would have been "insider trading." But I was still able to legally invest through funds and I made over $2 million in 20 years. Then it all disappeared when an underwriter (Lehman) went under and all the trillions of dollars they had on their books vanished literally overnight. It was little guys like me that were left holding the ball while the banksters were made as whole as possible with the capitol that was left. In the end I recovered $8000.

You might be surprised how little of a role potatoes play in the vodka market. They are too valuable as a foodstuff and their alcohol yield per kg. is low. And for anyone who says potatoes taste better, time to brush up on your knowledge of vodka. To be called Vodka means it is not allowed to have a flavour or aroma of the sugar source.With potatoes you can make vodka, so you're in luck.

Since I was a chem major, I had to follow the chemical companies...it's always been good to be able to figger out where ethylene and ammonia prices were going.I had invested money in stocks of the tech companies that I had worked with and known.

But your advise is wise -- we have a couple of great suppliers to our chemical biz, both equipment and raw materials...and we have some with scurvy. For some reason the culture of the good suppliers has benefitted their shareholders.

In the Netherlands we also have zero interest student loans, and a state scholarship that you can keep if you finish your study. The loan you start paying back when you start earning.

Quite some young people invest their loan.

And I can recommend this. Should have bought some more in the Corona dip. But I bought Shell. That also recovered nicely.

https://www.kempen.com/nl/kempen-global-high-dividend-fund-nv-ffNL0011755848

Quite some young people invest their loan.

And I can recommend this. Should have bought some more in the Corona dip. But I bought Shell. That also recovered nicely.

https://www.kempen.com/nl/kempen-global-high-dividend-fund-nv-ffNL0011755848

The US markets have had a decent pull-back this year but I think the economy is way ahead of it. I was in the UK last week; the state of the place!: crippling energy bills, transport strikes, NHS waiting lists, Felixstowe container port strike and even barristers are striking. Many big name high street shops are boarded up. It's not a good sign for the stock market.

Regarding US employment rate: did you hear of this thing where people accept multiple online jobs without telling each employer? Apparently this is much more lucrative than working really hard to get a raise from just one employer. Totally immoral but I have some respect for the cunning.

Regarding US employment rate: did you hear of this thing where people accept multiple online jobs without telling each employer? Apparently this is much more lucrative than working really hard to get a raise from just one employer. Totally immoral but I have some respect for the cunning.

To remain eligible for welfare benefits (in the US) one has to demonstrate that they are actively seeking full-time employment. Our aforementioned chemical biz gets a lot of applicants for jobs, and maybe 1 out of 50 show up for an interview.Regarding US employment rate: did you hear of this thing where people accept multiple online jobs without telling each employer? Apparently this is much more lucrative than working really hard to get a raise from just one employer. Totally immoral but I have some respect for the cunning.

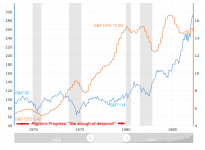

See the chart below, apropos of the market:

Attachments

We have 401Ks now rather than a pension for a good reason. You might find yourself working somewhere for years and find the executives found a way to drain the pension fund into their pockets.The US markets have had a decent pull-back this year but I think the economy is way ahead of it. I was in the UK last week; the state of the place!: crippling energy bills, transport strikes, NHS waiting lists, Felixstowe container port strike and even barristers are striking. Many big name high street shops are boarded up. It's not a good sign for the stock market.

Regarding US employment rate: did you hear of this thing where people accept multiple online jobs without telling each employer? Apparently this is much more lucrative than working really hard to get a raise from just one employer. Totally immoral but I have some respect for the cunning.

I would have to agree that accepting multiple online jobs would be bad but I would shake their hand if they pull it off.

Putting the money aside for a moment, please consider that working full-time and studying at the same time can be taxing, i successfully did it for one year a while back and its success hinged upon the team i had that year. They were all full-time students but i had knowledge of the subject matter from before so it was a good match. The class split up the second year and i didn't do so well.

When it comes to investing borrowed money it can sometimes be a good idea but like people have said before, how much time are you willing to put into investing, alongside work and studying? It sounds like not a lot, so best to go with a cheap index fund with low fees.

Also, have a plan for what happens in case the studying doesn't go so well after a year or so, if the system is anything like ours as soon as you're not delivering the points you will start getting billed for interest and principal. Weigh the potential upside against the potential downside if both school and the investments go south.

If i were you i'd see if i could go down in time in my job, maybe work 4 days at the start to get a feel for it, that way i'd have a full day each week to dedicate to school. Most employers are positive to this, some countries even have laws that employers must allow it as long as sufficient notice beforehand is given.

Try to stack your chips as much as possible for a successful outcome is my advice.

When it comes to investing borrowed money it can sometimes be a good idea but like people have said before, how much time are you willing to put into investing, alongside work and studying? It sounds like not a lot, so best to go with a cheap index fund with low fees.

Also, have a plan for what happens in case the studying doesn't go so well after a year or so, if the system is anything like ours as soon as you're not delivering the points you will start getting billed for interest and principal. Weigh the potential upside against the potential downside if both school and the investments go south.

If i were you i'd see if i could go down in time in my job, maybe work 4 days at the start to get a feel for it, that way i'd have a full day each week to dedicate to school. Most employers are positive to this, some countries even have laws that employers must allow it as long as sufficient notice beforehand is given.

Try to stack your chips as much as possible for a successful outcome is my advice.

Here the maximum gains have been real estate (big money needed), gold (small amount needed), stock market (small amounts needed).

This is over 30 years.

It is only property / real estate that needs a large down payment, you can buy gold by the gram, for example. So my comments are about transaction size.

I would say look at the maximum long term gains in different sectors, and plan things so that you have a regular income from this investment in your old age.

Trends and long term returns vary from country to country, take the advice of investment bankers.

And stay on the safe rather than risky side when doing this.

This is over 30 years.

It is only property / real estate that needs a large down payment, you can buy gold by the gram, for example. So my comments are about transaction size.

I would say look at the maximum long term gains in different sectors, and plan things so that you have a regular income from this investment in your old age.

Trends and long term returns vary from country to country, take the advice of investment bankers.

And stay on the safe rather than risky side when doing this.

Last edited:

Member

Joined 2009

Paid Member

At the same time I keep reading people are still sitting on cash -The US markets have had a decent pull-back this year but I think the economy is way ahead of it. I was in the UK last week; the state of the place!: crippling energy bills, transport strikes, NHS waiting lists, Felixstowe container port strike and even barristers are striking. Many big name high street shops are boarded up. It's not a good sign for the stock market.

Regarding US employment rate: did you hear of this thing where people accept multiple online jobs without telling each employer? Apparently this is much more lucrative than working really hard to get a raise from just one employer. Totally immoral but I have some respect for the cunning.

Household checkable deposits stand at $4.4Trillion, before COVID and government transfer payments they were $1.3 Trillion. There's simply too much liquidity in the system.At the same time I keep reading people are still sitting on cash -

Households which typically kept a few hundred dollars in their checking accounts now have thousands.

Because people a finally learning their lesson - that running the budget up to with ten dollars of your paycheck every week is a recipe for being one of the SUCKERS who end up having to sell off their investments at a loss to cover living expenses every time the $*** hits the fan. And it’s been happening more and more frequently now. I’ve never felt comfortable with LESS than $40k in a checking account. Too many things can go wrong.

Yesterday there was a news item in the paper that some Western funds are pulling out of Chinese real estate.

Some of those names are famed for manipulation, high returns in short term and so on.

That means a lot of that money will show up elsewhere, and create abnormal conditions in those new markets.

After all, they have to earn money for their investors, and also huge bonuses for their employees.

So, stay away from sectors you feel are over priced, or too risky.

Moderators, please delete this post if you find it offensive in any way.

Some of those names are famed for manipulation, high returns in short term and so on.

That means a lot of that money will show up elsewhere, and create abnormal conditions in those new markets.

After all, they have to earn money for their investors, and also huge bonuses for their employees.

So, stay away from sectors you feel are over priced, or too risky.

Moderators, please delete this post if you find it offensive in any way.

Last edited:

Just got the first payout, my first investment:

I decided to invest in a reasonably priced balanced ventilation system with heat recovery, reducing the need for heating and at the same time improving air quality through the use of filters.

Energy prices are absolutely insane in Europe now, and there's no hope for improvement for the foreseeable future.

The stock market seems to be unpredictable still, so I decided a further reduction in energy requirements will be a safer investment.

Edit:

FYI there's been several days in a row where electric energy costs have broken new all time high prices, and there's active talk of planned energy rationing sometime during March 2023. Energy prices are expected to remain high for a longer period of time, and will probably remain high even after the war ends. This is effectively crippling production and manufacturing as well as raw material cost and will cause further economic impact.

It's very possible I'm wrong, but I do expect a further decrease in the stock markets.

I decided to invest in a reasonably priced balanced ventilation system with heat recovery, reducing the need for heating and at the same time improving air quality through the use of filters.

Energy prices are absolutely insane in Europe now, and there's no hope for improvement for the foreseeable future.

The stock market seems to be unpredictable still, so I decided a further reduction in energy requirements will be a safer investment.

Edit:

FYI there's been several days in a row where electric energy costs have broken new all time high prices, and there's active talk of planned energy rationing sometime during March 2023. Energy prices are expected to remain high for a longer period of time, and will probably remain high even after the war ends. This is effectively crippling production and manufacturing as well as raw material cost and will cause further economic impact.

It's very possible I'm wrong, but I do expect a further decrease in the stock markets.

Last edited:

I don't understand how you lost so much money in 2007 - you must have had it invested in products you could'nt bail out of? - never be afraid to take a profit or to take a loss. The problem is that there are so many people around who let their egos get in the way of common sense - in business ego has no value.

I lost everything in 2008 when Lehman collapsed. I was diversified and had investments through multiple brokerage houses. What I didn't realize was that Lehman was the underwriter of every penny.

Even so, Lehman's collapse caught everyone by surprise. I didn't think such an event was possible but they falsified their margin accounts and got caught in a situation they couldn't cover up. Plus rehypothecated investments collapse like a house of cards. Trillions of dollars evaporated overnight.

https://en.wikipedia.org/wiki/Bankruptcy_of_Lehman_Brothers

Lehman's collapse was the big turning point.

The Lehman problem -- they ate their own cooking.I lost everything in 2008 when Lehman collapsed. I was diversified and had investments through multiple brokerage houses. What I didn't realize was that Lehman was the underwriter of every penny.

How did you lose everything? No SIPC protection?

Bear Stearns got no help until JPMorgan moved in. The price JPM paid was about equal to the cost of the BSC building on Madison Avenue. Bear also had huge reserves -- their problem actually started in the Investment Management Division, but the mortgage traders were always a smarmy group.

- Status

- Not open for further replies.

- Home

- Member Areas

- The Lounge

- Investments/Stocks/Funds