Ultima - I don't know. If you can link to them I'll check them out.

Scott - When the robots are doing all the work, the robots with their

AI and omnipotency will run the economies, hopefully for the betterment

of man or we'll all be screwed. The best of the brightest are already

warning about atonimous robots with AI....I wonder why?

KCT - The kid is happy, is that bubble gum money?

My Pop sold his shares to his golfing buddy broker

I think it ended up like being 1 share for 4 of the Stein-Hall

shares. I haven't looked at the Berkshire-Hathaway I think

is trading pretty high these days.

My Pop confirmed for me that of all his investments that was

the one that pissed him off the most...as the broker hadn't heard

of it or wasn't sure what the Berksire Hathaway would do. But he got

the inside BS for the stein-hall stocks that were going to

make Wall Street mega bucks.

Owning the 5 original shares of Berkshire would be a nice

addition to anybody's portfolio. S-H is nothing ness.

Mom and his sister (Warren Buffett), were bridge friends and it was through

her advise that pop bought the shares to begin with...

20/20 hind sight is to hang on and don't sell.

Had I also known what I know now, back in the early 70s when

my best friends dad has to sell off some of his land, and that being

a mountain top overlooking East Ridge Mall in San Jose, we couldn't

belive that one guy could pay that much and build the best house,

with the best fence and best swimming pool over looking one

of the nations future prospects for growth...Silicon Valley, USA.

We laughed then, who's ever heard of Intel, and how'd he get so

much money we wondered. I should have saved money from my

odd jobs as a kid waiting tables, doing dishes, running errands etc

and bout some Intel stock.

Cities incorporate farm land and use eminent domain to get land.

Once land in incorporated the taxes go up and land owner have to sell.

They used to own the orchards and three big mountains over on East San Jose.

Currently they have a small ranch on one side their son owns...but the

acreage is not what it once was.

But how do you know?

Cheers,

Scott - When the robots are doing all the work, the robots with their

AI and omnipotency will run the economies, hopefully for the betterment

of man or we'll all be screwed. The best of the brightest are already

warning about atonimous robots with AI....I wonder why?

KCT - The kid is happy, is that bubble gum money?

My Pop sold his shares to his golfing buddy broker

I think it ended up like being 1 share for 4 of the Stein-Hall

shares. I haven't looked at the Berkshire-Hathaway I think

is trading pretty high these days.

My Pop confirmed for me that of all his investments that was

the one that pissed him off the most...as the broker hadn't heard

of it or wasn't sure what the Berksire Hathaway would do. But he got

the inside BS for the stein-hall stocks that were going to

make Wall Street mega bucks.

Owning the 5 original shares of Berkshire would be a nice

addition to anybody's portfolio. S-H is nothing ness.

Mom and his sister (Warren Buffett), were bridge friends and it was through

her advise that pop bought the shares to begin with...

20/20 hind sight is to hang on and don't sell.

Had I also known what I know now, back in the early 70s when

my best friends dad has to sell off some of his land, and that being

a mountain top overlooking East Ridge Mall in San Jose, we couldn't

belive that one guy could pay that much and build the best house,

with the best fence and best swimming pool over looking one

of the nations future prospects for growth...Silicon Valley, USA.

We laughed then, who's ever heard of Intel, and how'd he get so

much money we wondered. I should have saved money from my

odd jobs as a kid waiting tables, doing dishes, running errands etc

and bout some Intel stock.

Cities incorporate farm land and use eminent domain to get land.

Once land in incorporated the taxes go up and land owner have to sell.

They used to own the orchards and three big mountains over on East San Jose.

Currently they have a small ranch on one side their son owns...but the

acreage is not what it once was.

But how do you know?

Cheers,

Last edited:

Owning the 5 original shares of Berkshire would be a nice addition to anybody's portfolio. S-H is nothing ness.

For the past 5 years I have been cleaning up records of my uncles, mom and grand-mom.

Only 2 weeks ago I found my grand-mothers record book -- the original purchase of "Electric Boat" in the very early 1920's and the record of the name change to General Dynamics! Over the generations the stock was parcelled out and gifted to charities.

She had also purchased SOCONY - which was Standard Oil of NY -- not NJ. SOCONY was the predecessor of Mobil which later merged with Exxon.

They were very frugal people who invested in stocks, property and porcelain. The property didn't work out that well in the formerly industrialized midwest!

Jack,

Good for them, that they actually kept records of it all.

I'm sure they went through some very tough times trying

to hang on to them. Stocks, bonds and such can be

pretty interesting once we start looking into stuff.

How did the porcelains turn out? What did they

like, buy etc? Figure (enes), dishes, plates, mugs?

or the seasonal things?

It doesn't matter I'm just interested in things...

Wedgewood, Royal Daoulton and others.

My grandfather we called him "Gaffer"

as the Godfather...Collected some really

fun porcelian mugs jugs and steins.

Yes the Toby jugs.

Good for them, that they actually kept records of it all.

I'm sure they went through some very tough times trying

to hang on to them. Stocks, bonds and such can be

pretty interesting once we start looking into stuff.

How did the porcelains turn out? What did they

like, buy etc? Figure (enes), dishes, plates, mugs?

or the seasonal things?

It doesn't matter I'm just interested in things...

Wedgewood, Royal Daoulton and others.

My grandfather we called him "Gaffer"

as the Godfather...Collected some really

fun porcelian mugs jugs and steins.

Yes the Toby jugs.

someone from Seattle who was in my dorm at college later claimed they had a phone call from a high school buddy who dropped out of Harvard

claims his end of the converstion was something like, "it's nice that you have a contract for some software Bill but I think I'll stay and get my degree..."

SyncTronX,

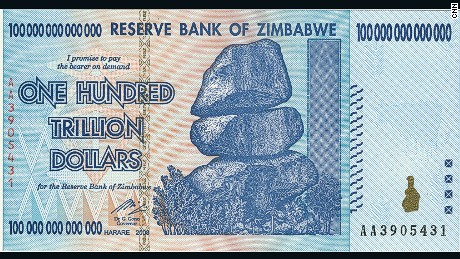

yeah, the kid seems happy as any millionaire should be.

I think he is holding a pile of Zimbabwe Dollars which are as worthless as pretty much any colorful paper that is circulating in various places.

I got a couple of the grand daddy's, they make great bookmarks and gifts, so technically that makes me a filthy trillionaire.

The 'worthless' 100 trillion dollar bank note - CNN

yeah, the kid seems happy as any millionaire should be.

I think he is holding a pile of Zimbabwe Dollars which are as worthless as pretty much any colorful paper that is circulating in various places.

I got a couple of the grand daddy's, they make great bookmarks and gifts, so technically that makes me a filthy trillionaire.

The 'worthless' 100 trillion dollar bank note - CNN

I forget who, someone was suggesting to play the point spread with a home

equity loan/line of credit.

I understand the idea, my question is in what have people invested.

Reason I ask as FED Chairperson J. Yellen, mentioned if things reamain

as they are, they will be slowly increasing the federal funds rate....

through 2020 and beyond to 2.9 percent.

So, that said going from the current 1.4 percent,

and knowing that the as interest rates rise, prices decrease,

for an investment consideration, how do we avoid the loss

selling a year later,?

or rolling over?

or just working the spread?

The last thing someone wants is to

lose money when it comes time to sell

because interest rates go up and the price goes down.

Then there are Options....

Not that I want to lose the house

or lose money on options....

risk adverse I am.

But, wondering, what kind of financial instruments are available

in credit package purchases? Are they less than $1 million instruments?

Is is possible to work with a conservative team of investors to do a group

paper buy?

I'm thinking there should be something, but what?

Cheers,

equity loan/line of credit.

I understand the idea, my question is in what have people invested.

Reason I ask as FED Chairperson J. Yellen, mentioned if things reamain

as they are, they will be slowly increasing the federal funds rate....

through 2020 and beyond to 2.9 percent.

So, that said going from the current 1.4 percent,

and knowing that the as interest rates rise, prices decrease,

for an investment consideration, how do we avoid the loss

selling a year later,?

or rolling over?

or just working the spread?

The last thing someone wants is to

lose money when it comes time to sell

because interest rates go up and the price goes down.

Then there are Options....

Not that I want to lose the house

or lose money on options....

risk adverse I am.

But, wondering, what kind of financial instruments are available

in credit package purchases? Are they less than $1 million instruments?

Is is possible to work with a conservative team of investors to do a group

paper buy?

I'm thinking there should be something, but what?

Cheers,

You can sell short a mutual fund (or an ETF) which holds government bonds. Here is a list that 3 seconds of Googling turned up

Interest rates rise --> bond prices fall --> your short position increases in value

Interest rates rise --> bond prices fall --> your short position increases in value

Mark,

Yes, and if economy slows...and rates stay the same.

Hmmm gov't yields aren't so hot.

There should be some good commercial paper?

Time to subscribe to the WSJ again to get good information.

That and Consuelo Mack's WealthTrack that Jack mentioned.

Cheers,

Yes, and if economy slows...and rates stay the same.

Hmmm gov't yields aren't so hot.

There should be some good commercial paper?

Time to subscribe to the WSJ again to get good information.

That and Consuelo Mack's WealthTrack that Jack mentioned.

Cheers,

Last edited:

So, I guess that since the stock market is doing well

everyone is making money on their investments.

Anything in that will go beyond the bubble?

Margin Call in Saudi?

The saudi gov considers to free the imprisoned billionaires if they part with up to 70% of they're money and hand it to the rulers.

Its always about money, your money, you are not suppose to have any and if you do you are by definition a terrorist, money launderer, drug dealer, prostitute or speculator that needs to be dealt with....

Its always about money, your money, you are not suppose to have any and if you do you are by definition a terrorist, money launderer, drug dealer, prostitute or speculator that needs to be dealt with....

Sure - the situations are equivalent.The saudi gov considers to free the imprisoned billionaires if they part with up to 70% of they're money and hand it to the rulers.

Its always about money, your money, you are not suppose to have any and if you do you are by definition a terrorist, money launderer, drug dealer, prostitute or speculator that needs to be dealt with....

In the same way landing on the Moon is like parallel parking.

US equity market is showing that its underpinnings are under some early stress -- companies like Tractor Supply taken to the woodshed, but Boeing up 20 points in 2 days.

I am of the view that ETF's have made the markets less efficient. All the brokers do is move their retail clients into mutual funds and ETF's -- the typical retail broker has lost interest in individual stocks, and their managers are petrified of an AE going off the ranch and recommending individual companies to their clients.

I am of the view that ETF's have made the markets less efficient. All the brokers do is move their retail clients into mutual funds and ETF's -- the typical retail broker has lost interest in individual stocks, and their managers are petrified of an AE going off the ranch and recommending individual companies to their clients.

Ultima - I don't know. If you can link to them I'll check them out.

Long forgotten thread but here's a new fresh study from Oxfam published on 22 January 2018.

Richest 1 percent bagged 82 percent of wealth created last year - poorest half of humanity got nothing | Oxfam International

Permalink (same as above): Richest 1 percent bagged 82 percent of wealth created last year - poorest half of humanity got nothing | Oxfam International

- Status

- This old topic is closed. If you want to reopen this topic, contact a moderator using the "Report Post" button.

- Home

- Member Areas

- The Lounge

- DIYinvest