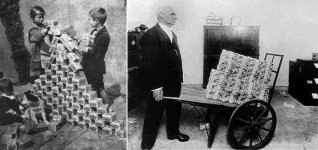

Germany knew all about that, in the interbellum. The people carted wheelbarrows of money to the shops for a loaf of bread.

Ever seen a bill of 50 billion Deutsche Mark?

Jan

Ever seen a bill of 50 billion Deutsche Mark?

Jan

Attachments

Last edited:

When all the work is being done by robots everyone will be getting money made

of numbers magically appearing in their bank accounts

Mine already does that.

Last edited:

Why do we need government approved Tax and Investments advisors ?

Trying to minimize the number of times you get screwed ?

Jan

Bernard Madoff was a government approved investment advisor yet he successfully screwed his customers very badly.

Since we are talking investments here, I use this spreadsheet as one guide to investing in Canadian dividend paying stocks.

To get on the list the company must pay a dividend AND that dividend must increase every year for at least 5 years.

The spreadsheet is updated monthly.

Canadian Dividend All-Star List - DGI&R

yes I have bought a few on the list

To get on the list the company must pay a dividend AND that dividend must increase every year for at least 5 years.

The spreadsheet is updated monthly.

Canadian Dividend All-Star List - DGI&R

yes I have bought a few on the list

Also in my portfolio are 20 shares of Stein-Hall.

They are worthless.

A side note here I got these shares from my pop.

My pop got them when his golfing buddy stock broker

wanted pop to get out of some little company no one had

ever heard of. This company was started by the brother of

one of my mom's best friends and she thought my mom and

pop should buy a few shares of stock in the company.

They did, then sold it all and bought the Stein-Hall Stock,

which was going to be a big hit!

It wasn't...oh well.

Cheers,

They are worthless.

A side note here I got these shares from my pop.

My pop got them when his golfing buddy stock broker

wanted pop to get out of some little company no one had

ever heard of. This company was started by the brother of

one of my mom's best friends and she thought my mom and

pop should buy a few shares of stock in the company.

They did, then sold it all and bought the Stein-Hall Stock,

which was going to be a big hit!

It wasn't...oh well.

Cheers,

(snippage)

Here's a hint -- when a great portfolio manager is on Consuelo Mack's show, reviewed in Barrons or Investor's Business Daily --- go to the Morningstar and get a copy of their portfolio and see what they invest in. (Mack can pick and choose the folks she interviews, no rumballs or touts!).

They've done most of the work. Investigate the companies on your own, listen to the post-earnings conference call.

That is pretty good Jack. Thank you and others here for sharing.

Maybe it's time for me to start selling off my vintage amps

and some of my guitars and investing it.

You've given me a source for good basic research, that's already been done

for the most part. I'll go and see if I can't start to find some of the stocks

and recommends from Consuelo Mack's show on PBS.

My wife is interested and I can teach her some of this stuff. She actually

wasn't sure what a stock was and thought you just bought it and sold it a year

later....I guess if you are a "trader" and do it more often.

It's interesting to note that some of the hot shots and people many have

never heard about is how easily we are being manipulated.

So imagine you are a "trader" say you are in LA, Chicago, Miami

(LACM). You have to trade through someone or something which is located,

or is going though someone who's network is physically right next to

the NYSE Servers computer network...say within 20 feet or less.

They have their own mathematicians and programmers who've written

code so that they can arbitrage the market based on time....

This means they can see what LACM is buying or selling and

beat them to the market every time. They can do it faster than

anyone else and make money...albeit not a lot, but over time

come out very profitable.

Rayma, that 10 percent or 20 percent is the capital requirement

that I had mentioned. It might be the savings account or other

deposits we have at a bank or other financial institution.

Some were time deposits...CDs and bonds with different maturities.

Then the banks could loan money based on their deposits and capital

requirements.

Then, when one segment of the market was doing really well and making

more than another segment: Auto Loans versus Mortgage loans.

Whoever wasn't making money would **** and moan and complain

that they couldn't compete...so they would lobby congress to get the

rules changed.

This is essentially what happened in the housing market.

The housing lenders couldn't keep up. With rising home prices

and a 20 percent down payment who could afford it?

Uncle Sam help us????

They did. They eliminated the 20 percent rule and substituted....

The 20, 10, 5, percent with primary mortgage insurance.

So now we couldn't afford the house then, but we can if we can only

come up with 5 percent down, take a second and third mortgage too

and only insure the initial amount.

Now people who can't afford homes can buy one. The lender didn't care

because they got their money for filling out the forms if you got approved.

Then someone else would buy all these mortgages, and bundle them up

and sell them off to someone else Fannie Mae, Freddi Mac, conforming

non conforming, who cares I get my money and someone else has to deal

with the mess.

When the bubble bursts... we all know what happens.

And guess what.

Now they can't make enough money any more and they want

to loosen up the lending requirements again.

Gov't is OVER REGULATING !!!!

That was rather long winded, hopefully someone understood.

if not maybe someone else can 'splain it.

Cheers

When the bubble bursts... we all know what happens.

There is a bubble slowly deflating right now -- subprime credit cards are witnessing a dramatic upsurge in late payments and charge-offs.

This, paradoxically, arises from the low interest regime which has forced up rents for the bottom quartile of wage earners. Higher medical costs and lower wage growth also contributing.

I answer my own question.

-absolutely Nothing-

Could this be a coincidence or perhaps is this by design ?

If this is by design, then one might ask, who is in charge of public school system ?

Government perhaps ? I mean, the same people that bail out failed banks with taxpayer funds.

In essence the population is kept in the dark as far as the subject of money, currency and taxes is concerned. So much so, that they depend on investment and tax advisors to tell them what to do. So naturally this offers a great opportunity for these plebs to be separated from they're money, totally legal of course.

And of course these advisors are first class and hold the appropriate approvals and certifications permitting them to operate in this advisory business.

Inquiring minds might ask who is in charge of these approvals....

Yup, you guessed it !

Bottom line:

Get them plebs to be smart enough to operate computers and machines but keep'em dumb enough to put money into a bank and buy stocks or other wonderful banker papers.

What have (I, we, you) learned about money (and currency and taxes) in public school ?

-absolutely Nothing-

Could this be a coincidence or perhaps is this by design ?

If this is by design, then one might ask, who is in charge of public school system ?

Government perhaps ? I mean, the same people that bail out failed banks with taxpayer funds.

In essence the population is kept in the dark as far as the subject of money, currency and taxes is concerned. So much so, that they depend on investment and tax advisors to tell them what to do. So naturally this offers a great opportunity for these plebs to be separated from they're money, totally legal of course.

And of course these advisors are first class and hold the appropriate approvals and certifications permitting them to operate in this advisory business.

Inquiring minds might ask who is in charge of these approvals....

Yup, you guessed it !

Bottom line:

Get them plebs to be smart enough to operate computers and machines but keep'em dumb enough to put money into a bank and buy stocks or other wonderful banker papers.

Last edited:

KCT,

I've learned about money in public schools, I am a rather

unique case. I am also an educator and I can speak with

some experience and authority as to what you mentioned

and I generally agree with your opinion/observation.

Background:

In high school, way back then it was a basic what is money

class about baking, balancing a check book, how to save and

along with other related stuff. I think the class was called

personal finance...circa 1976?

In public universities...I had years of intensive study in the early 1980s.

I earned two business degrees, BBA - Accounting, BBA - Finance

from Texas A&M University. Working my way through school I had

jobs doing accounting for a world wide directional drilling oilfield service

company and mortgage banking experience.

I wanted to learn the hard skills that would apply to

any business.

Anyone can learn basic management or marketing

skills on the job--it's a lot more difficult to get a feeling for what

the numbers say on a balance sheet or income statement and know what to do with it.

The most difficult of those to get a handle on are the hard skills of accounting and finance.

It is also difficult to get a feeling for what advisors might be telling you

what to do and whether what they are telling you is correct or B.S.

Trying to Separate the wheat from the Chaff.

I mentioned the above so that you have a better understanding of

part of my background, not because I think I'm better than anyone

or tooting my own horn, rather it is based on education and study.

KCT Asks: Could this be a coincidence or perhaps is this by design ?

KCT, please consider the following and know the answer is

much less a conspiracy (conspiratorally--is that a word?) as its

more a systemic problem, (if it is a problem [a product of the system]).

Imagine my surprise when I started teaching in high school and

discovered that economics in middle and high schools was taught

by social studies teachers, who had virtually no business economics training nor business experience or taught by home economics teachers.

They are teachers who want to teach little kids the basic feel good stuff.

It is rare to find someone with real business degrees and experience teaching in elementary or middle school and if lucky

a few of them may teach in secondary schools.

For most teachers they want to a "teachers college" and learned all about

early child education through secondary education and their related

knowledge, skills, process, and procedures.

I've head many of my teaching colleagues mention that if they had to take a

business class such as management, economics, statistics, marketing, etc,

'they took the classes at a junior college so it wouldn't affect their GPA.

They want teachers to have a better than C average to teach kids.

This average is at a teachers college, not a technical college or hard business

school grade point average. The teaching administrators and support systems

and organizations restrict teaching to those who earned better than a 2.75, or

maybe 3.0 or a 3.25 or better all based on a 4.0 grading scale.

Those of you who earned degrees at world class institutions in EE, Math, Physics,

Chemistry, or other hard sciences and only managed to graduate with a 2.75 to 3.0 average might not be eligible to teach our children.

If you earned a degree at a second or lower tiered college and earned a degree

in how to teach social studies, English, reading, math and sciences and you

kept your GPA up above 3.0 to 3.25 you would get a teaching job ahead of

any of the hard science or math people...because they wouldn't be qualified.

Let me tell you, the teaching organizations would support the administrators

barring the hard science people.

What are the educators missing?

If someone had real business experience they can make more

money than even seasoned and good teachers.

If you are a good teacher and you teach long enough you are

screwed because you get locked in, you don't have job marketable

skills and no business would hire you after being dumbed down

by Principals and administrators for twenty, thirty, or more years.

It's education, it is not business.

Love a teacher, they NEED it.

I've learned about money in public schools, I am a rather

unique case. I am also an educator and I can speak with

some experience and authority as to what you mentioned

and I generally agree with your opinion/observation.

Background:

In high school, way back then it was a basic what is money

class about baking, balancing a check book, how to save and

along with other related stuff. I think the class was called

personal finance...circa 1976?

In public universities...I had years of intensive study in the early 1980s.

I earned two business degrees, BBA - Accounting, BBA - Finance

from Texas A&M University. Working my way through school I had

jobs doing accounting for a world wide directional drilling oilfield service

company and mortgage banking experience.

I wanted to learn the hard skills that would apply to

any business.

Anyone can learn basic management or marketing

skills on the job--it's a lot more difficult to get a feeling for what

the numbers say on a balance sheet or income statement and know what to do with it.

The most difficult of those to get a handle on are the hard skills of accounting and finance.

It is also difficult to get a feeling for what advisors might be telling you

what to do and whether what they are telling you is correct or B.S.

Trying to Separate the wheat from the Chaff.

I mentioned the above so that you have a better understanding of

part of my background, not because I think I'm better than anyone

or tooting my own horn, rather it is based on education and study.

KCT Asks: Could this be a coincidence or perhaps is this by design ?

KCT, please consider the following and know the answer is

much less a conspiracy (conspiratorally--is that a word?) as its

more a systemic problem, (if it is a problem [a product of the system]).

Imagine my surprise when I started teaching in high school and

discovered that economics in middle and high schools was taught

by social studies teachers, who had virtually no business economics training nor business experience or taught by home economics teachers.

They are teachers who want to teach little kids the basic feel good stuff.

It is rare to find someone with real business degrees and experience teaching in elementary or middle school and if lucky

a few of them may teach in secondary schools.

For most teachers they want to a "teachers college" and learned all about

early child education through secondary education and their related

knowledge, skills, process, and procedures.

I've head many of my teaching colleagues mention that if they had to take a

business class such as management, economics, statistics, marketing, etc,

'they took the classes at a junior college so it wouldn't affect their GPA.

They want teachers to have a better than C average to teach kids.

This average is at a teachers college, not a technical college or hard business

school grade point average. The teaching administrators and support systems

and organizations restrict teaching to those who earned better than a 2.75, or

maybe 3.0 or a 3.25 or better all based on a 4.0 grading scale.

Those of you who earned degrees at world class institutions in EE, Math, Physics,

Chemistry, or other hard sciences and only managed to graduate with a 2.75 to 3.0 average might not be eligible to teach our children.

If you earned a degree at a second or lower tiered college and earned a degree

in how to teach social studies, English, reading, math and sciences and you

kept your GPA up above 3.0 to 3.25 you would get a teaching job ahead of

any of the hard science or math people...because they wouldn't be qualified.

Let me tell you, the teaching organizations would support the administrators

barring the hard science people.

What are the educators missing?

If someone had real business experience they can make more

money than even seasoned and good teachers.

If you are a good teacher and you teach long enough you are

screwed because you get locked in, you don't have job marketable

skills and no business would hire you after being dumbed down

by Principals and administrators for twenty, thirty, or more years.

It's education, it is not business.

Love a teacher, they NEED it.

Last edited:

Yes and no. I was shocked when I learned that a bank can multiply money. That is to say, if someone deposits $1 to a brand new bank, the bank can lend out $2 or $10 or more, in the hope that the depositor doesn't claim their $1 back before the loans are repaid. There is a regulation on the maximum multiplication allowed but I think someone told me it was a big number, like 20. Not sure though.Is that really true? I would think that when the bank lends me money, their own balance is depleted by the amount they give to me. Of course they don't lose money either, because I owe them what they just gave away.

It doesn't seem like a creation of anything.

Actually when you think it through, and assuming that the money the bank lend me is money that someone else owes to the bank, the only thing that changes is responsibility for payback for that amount. It now rests with me ;-)

Jan

But this is the basis of a monetary system as opposed to an exchange token system like bitcoins. Each unit of modern money is really an IOU that is used as a placeholder for exchange of goods or services. If you think about it, as more people make transactions there will be more demand for IOUs. If the number of IOUs is fixed then the "value" of each IOU will rise as number and size of transactions increase. In a growing economy, the banks need to create more IOUs out of thin air to keep the value of existing IOUs from rising too fast. If the value of money rises too fast it causes savers to thrive and borrowers to perish and incents people to hoard money and reduce transactions, a vicious circle. Equally, if the economy is shrinking the banks can destroy money. This is why they dropped the gold standard.

Eg: the price of bitcoins is rocketing because the amount of bitcoins is capped and the number of bitcoin transactions is growing fast and bitcoins are the most trusted at the moment.

Managing the amount of money in the system makes sense until governments start messing with it for political ends. Then it can go horribly wrong!

Yes and no. I was shocked when I learned that a bank can multiply money. That is to say, if someone deposits $1 to a brand new bank, the bank can lend out $2 or $10 or more, in the hope that the depositor doesn't claim their $1 back before the loans are repaid. There is a regulation on the maximum multiplication allowed but I think someone told me it was a big number, like 20. Not sure though.

For the last 8 years the most profitable area for bank operations was for the banks themselves to lend their reserves back to the Federal Reserve, as the Fed paid interest on reserves (reserves are currency and gold)

The US credit system is now partially fiat money, i.e. that created by commercial banks levering their balance sheets, lending to businesses and individuals but mostly credit created through intermediaries. Your credit card balance is sold and packaged into a credit card receivable security, as is your home mortgage or auto loan. These packaged securities are purchased by insurance companies, money market mutual funds, state pension systems, etc.

ah.. funny money and the Fed, if G.E.Griffin, Bill Still etc. are to be believed it's neither federal nor a reserve but a private institution created 1913 by private bankers, even more funny is how the cabal have managed to spread the toilet paper all over the world, but it gets funnier, just think of China and their $ ~3 trillion foreign exchange reserve, if they start to show obstinacy the cabal may consider of phasing in Weimar 2.0 and there goes Chinas reserve in the toilet.

However, we live in some quite interesting times that's for sure.

However, we live in some quite interesting times that's for sure.

The Federal Reserve (FED) is good, it was created to prevent politics

from entering monetary policy decisions.

The FED is comprised of 12 districts/banks, the Federal Open Market Committee

and the board of governors which control the U.S. Central Bank.

Just imagine for instance if the FED was run by a political organization.

Too much politics ruins business.

There is way too much paranoia surrounding the FED. The FED is conservative

as a banking institution should be. They don't make predictions and you won't get

answers straight from their representatives either. That is not their job and

they take their job seriously.

As an educator, I was able to pay for my lunches and attend their educational

seminars. It's a good refresher for everything I forgot since my finance college

days. They do bring in financial professors from regional universities who

buttress the FEDs claims and as a prof can mention things like price and interest

rates move in opposite directions, etc.

One can glean high level information from them and some of their economists

are top notch.

Just know that I take a while to understand everything that goes on everywhere.

This all takes a while to get up the learning curve, just like electronics, or machining,

or auto motive or aircraft mechanics. We've got to keep at it and learn.

That good stuff Jack, just plain basic things to know what it happening.

Cheers,

from entering monetary policy decisions.

The FED is comprised of 12 districts/banks, the Federal Open Market Committee

and the board of governors which control the U.S. Central Bank.

Just imagine for instance if the FED was run by a political organization.

Too much politics ruins business.

There is way too much paranoia surrounding the FED. The FED is conservative

as a banking institution should be. They don't make predictions and you won't get

answers straight from their representatives either. That is not their job and

they take their job seriously.

As an educator, I was able to pay for my lunches and attend their educational

seminars. It's a good refresher for everything I forgot since my finance college

days. They do bring in financial professors from regional universities who

buttress the FEDs claims and as a prof can mention things like price and interest

rates move in opposite directions, etc.

One can glean high level information from them and some of their economists

are top notch.

Just know that I take a while to understand everything that goes on everywhere.

This all takes a while to get up the learning curve, just like electronics, or machining,

or auto motive or aircraft mechanics. We've got to keep at it and learn.

That good stuff Jack, just plain basic things to know what it happening.

Cheers,

Last edited:

Ai ai, I hear and take your info to my heart!

But what's up with all the QE, it seems to trickle down only into the pocket benefiting mostly major stock owners, in comparison to the Great Depression, this time around it seems like sort of an asymmetric inflation where only rich get richer skyrocketing away from the rest as do the housing market, just look at the inequality studies from Oxfam for instance., what's going on?

But what's up with all the QE, it seems to trickle down only into the pocket benefiting mostly major stock owners, in comparison to the Great Depression, this time around it seems like sort of an asymmetric inflation where only rich get richer skyrocketing away from the rest as do the housing market, just look at the inequality studies from Oxfam for instance., what's going on?

Also in my portfolio are 20 shares of Stein-Hall.

They are worthless.

A side note here I got these shares from my pop.

My pop got them when his golfing buddy stock broker

wanted pop to get out of some little company no one had

ever heard of. This company was started by the brother of

one of my mom's best friends and she thought my mom and

pop should buy a few shares of stock in the company.

They did, then sold it all and bought the Stein-Hall Stock,

which was going to be a big hit!

It wasn't...oh well.

Cheers,

Hi Sync,

another day, another piece of pretty looking worthless paper...

This is an interesting tale on the shares / stocks, so what happened to the small company shares the broker wanted him to sell ?

Cheers

Someone here on the forum suggested when been young to get a well paying job and so...

I guess this little fellow did very well for himself.

- Status

- This old topic is closed. If you want to reopen this topic, contact a moderator using the "Report Post" button.

- Home

- Member Areas

- The Lounge

- DIYinvest